An EIN—also known as an employer identification number—is often used to identify an estate when there is an active probate. The EIN is provided by the IRS and should be obtained by the personal representative or executor once the letters testamentary or letters of administration have been issued. The EIN is necessary for the personal representative to open up an estate bank account at a local or national bank.

The estate bank account is used to hold funds from the decedent’s estate until the probate is wrapped up and the funds from the estate bank account are distributed to the decedent’s beneficiaries. The EIN is also used if there are investments or other assets of the estate that are generating income so that the financial institutions can issue a Form 1099 to the estate.

To obtain an EIN for the estate, the personal representative or executor can apply online, by mail, or by filing a paper application for the EIN (SS-4).

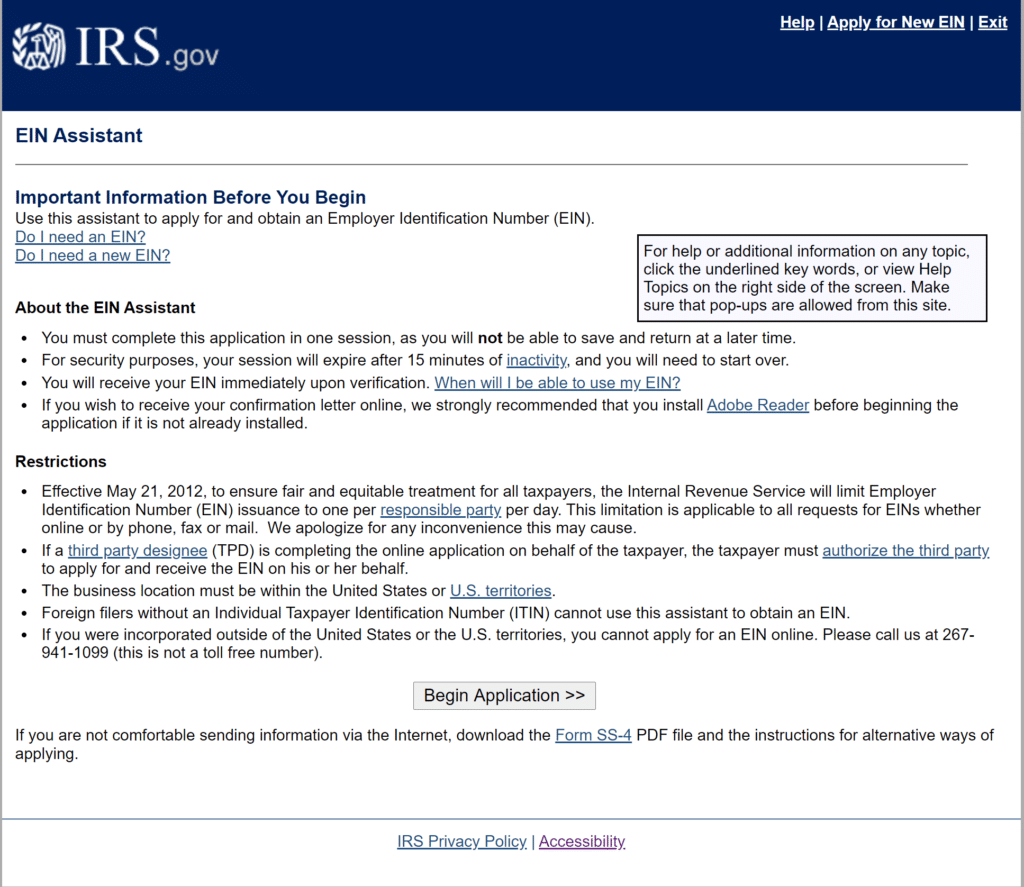

We recommend that you apply for the EIN online as it is the easiest way to do so. Here’s a quick step-by-step guide on how to apply for an estate EIN using the IRS’ website:

Table of Contents

Step 1

Navigate to the IRS’ online application portal, read through the instructions, and click “Begin Application.”

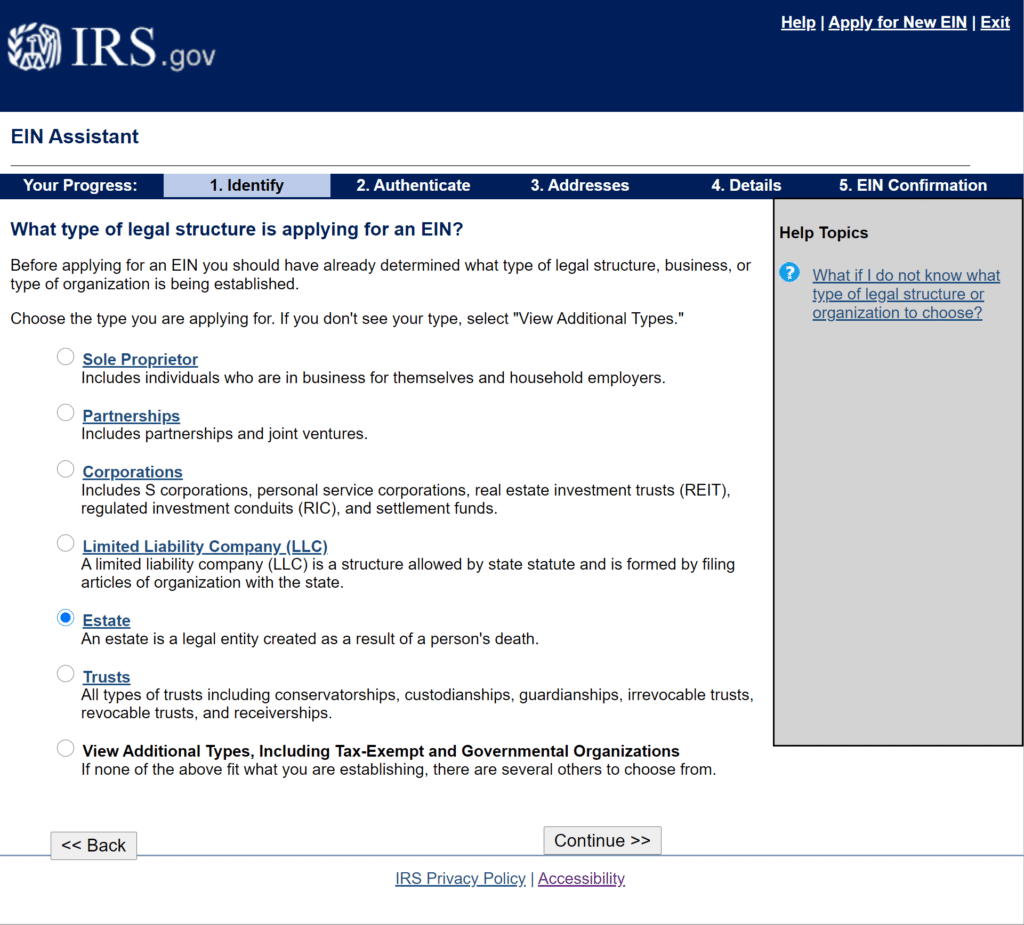

Step 2

Choose the Estate option if there is an open probate. If the decedent also had a Trust, then you should consult with an attorney as to whether or not you will also need an EIN for the Trust.

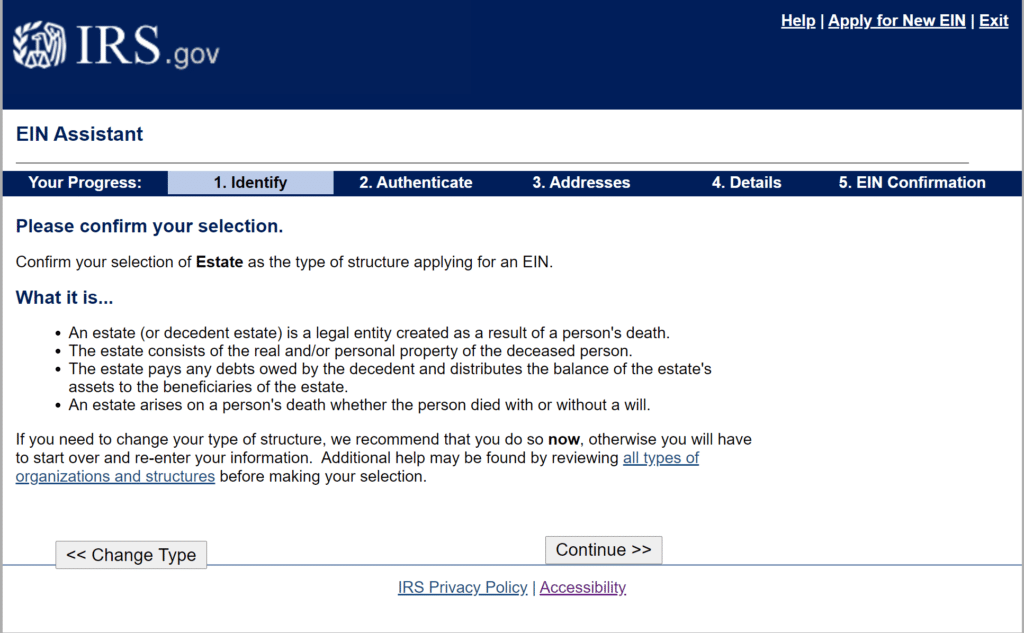

Step 3

Read the following prompt, make sure that you need an estate EIN, and then hit continue.

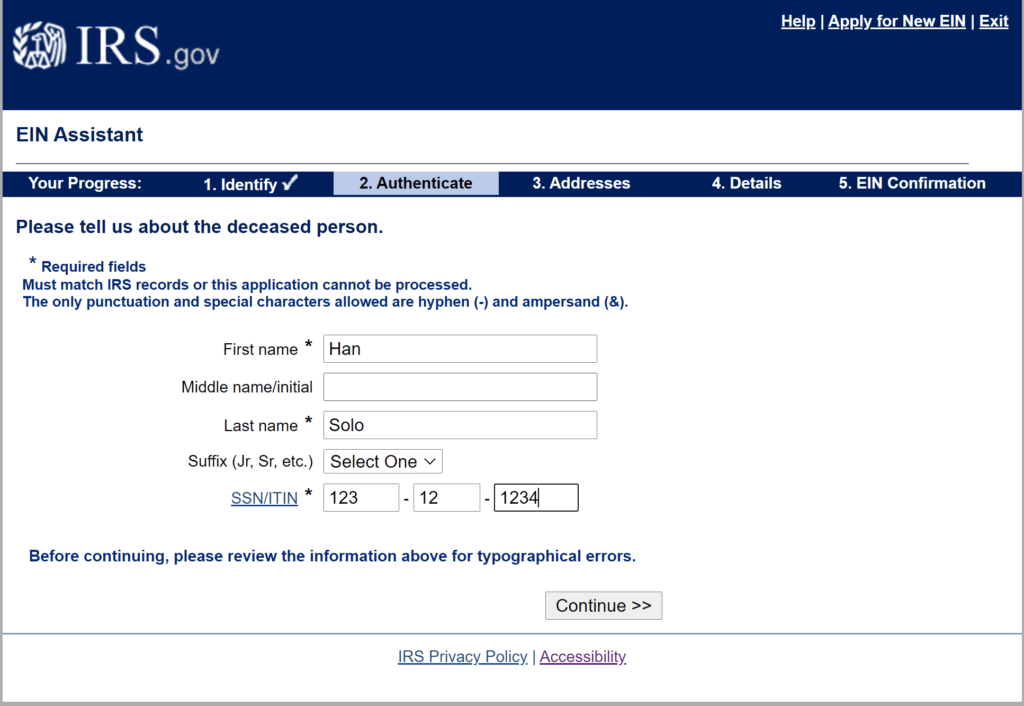

Step 4

You will type in the decedent’s name and social security number. Make sure the information you have matches IRS’ records otherwise you will be prevented from moving forward.

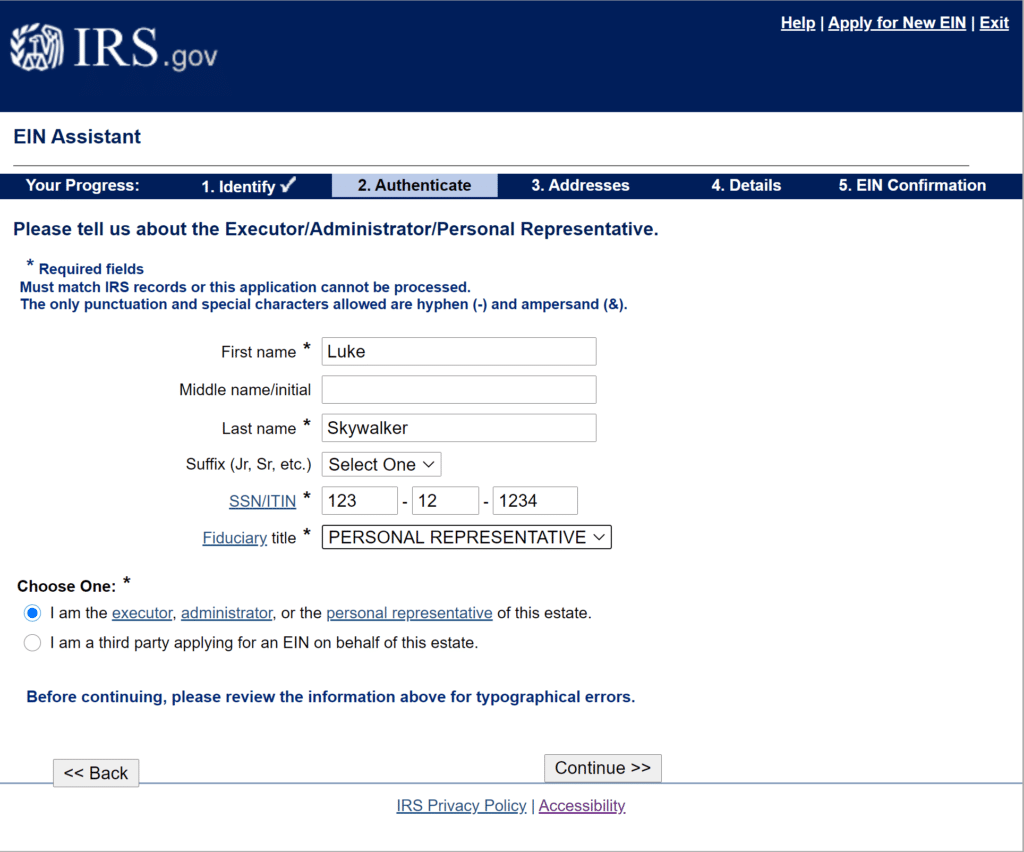

Step 5

If you are the personal representative, executor, or administrator applying for the EIN, then you will type in your identifying information. Again, your information must match IRS records or you will not be able to proceed. Make sure to choose the correct fiduciary title based on your state—either personal representative, executor, or administrator. Here in Florida we use the term personal representative.

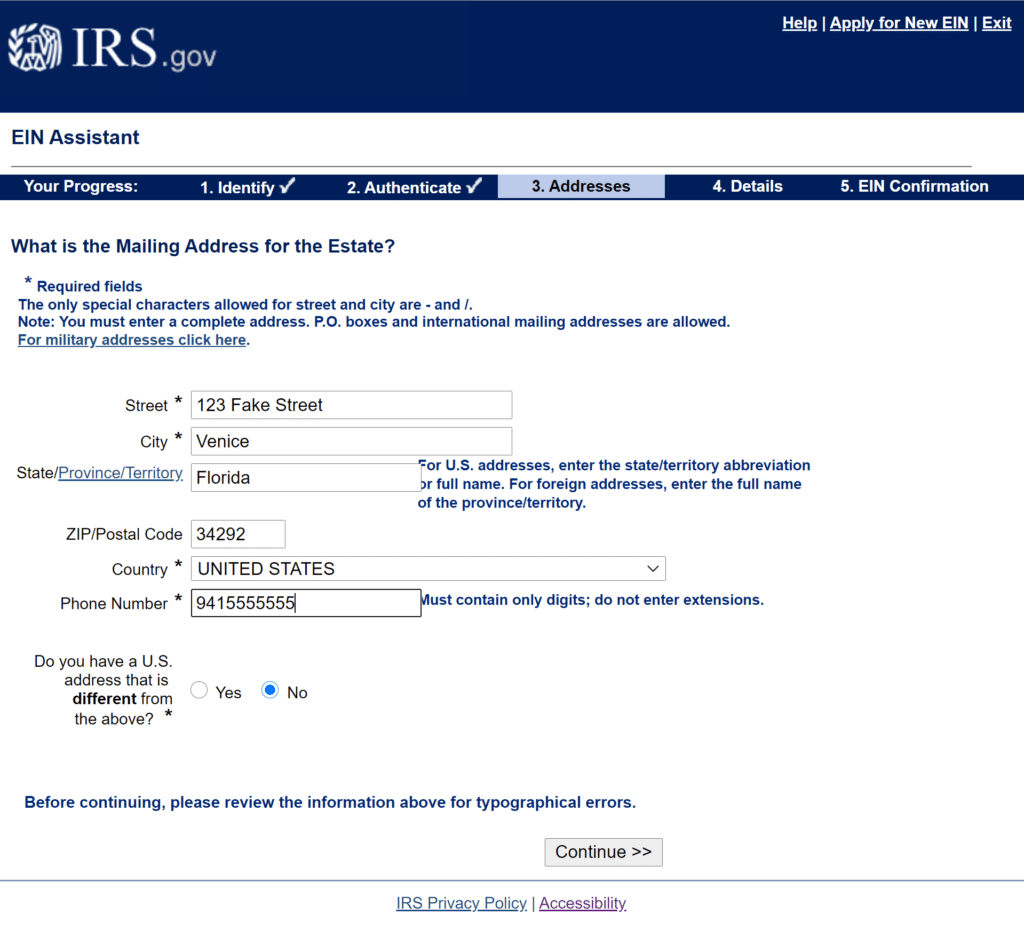

Step 6

You will type in the mailing address for the estate.

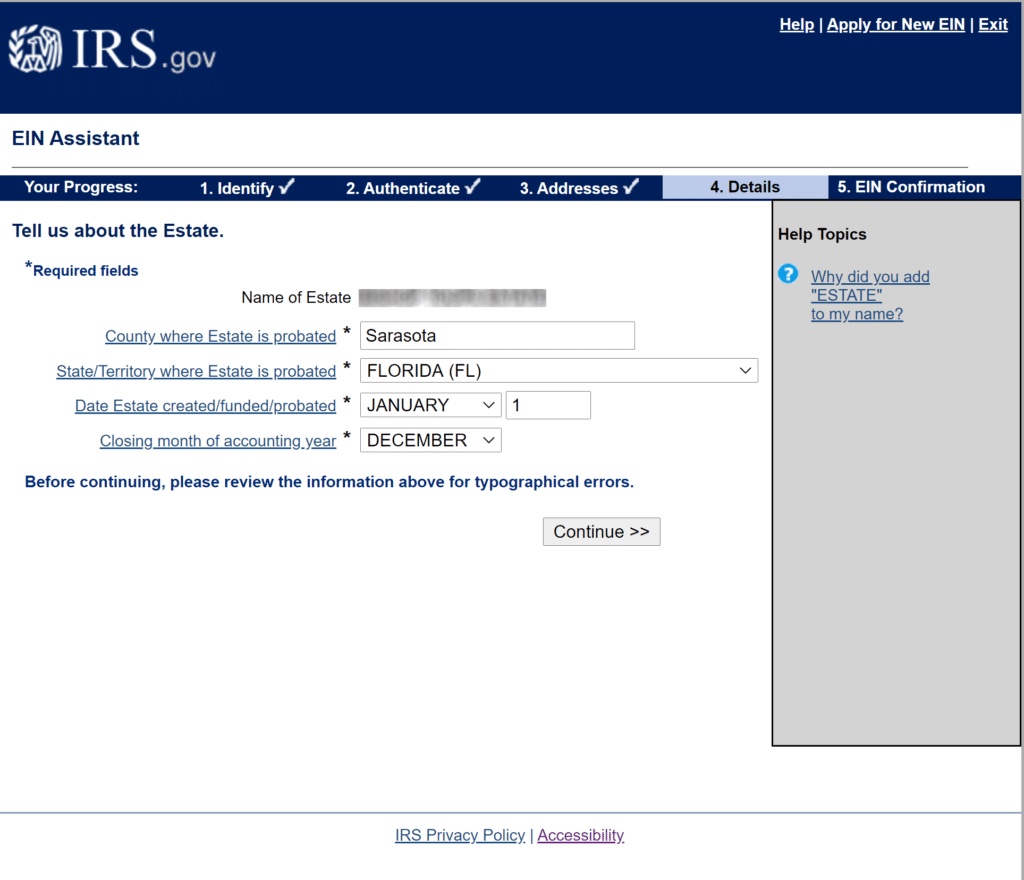

Step 7

You will type in the County and State where the estate is being probated. And you will type in the decedent’s date of death and the closing month of the accounting year. Most closing months for the accounting year will be in December.

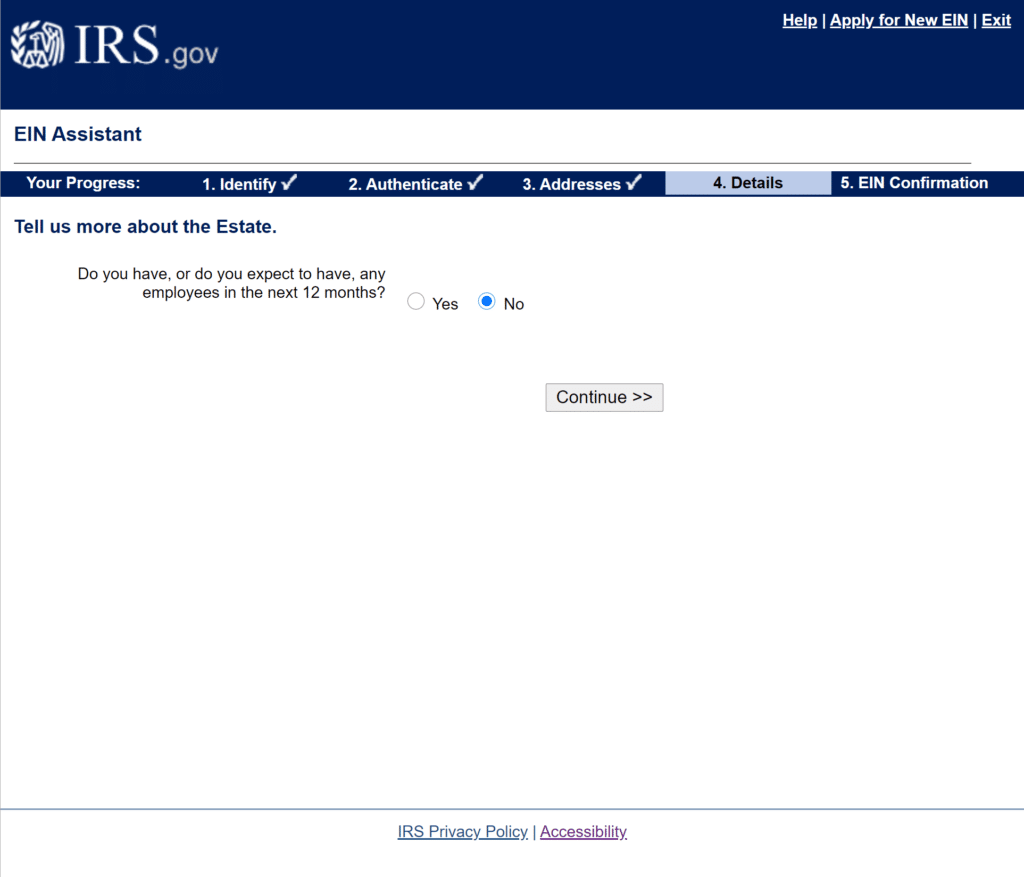

Step 8

You will choose either yes or no depending on whether the estate will hire any employees. Most estates will not have any employees. If you’re unsure, please consult with your attorney.

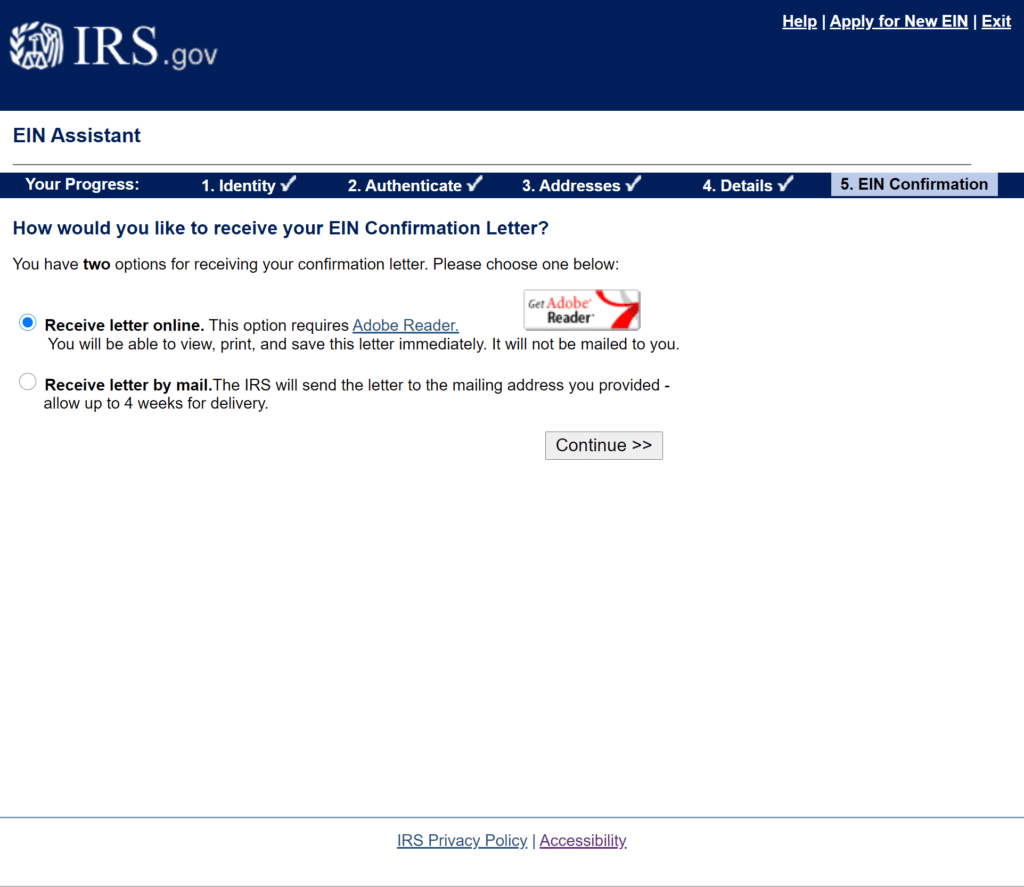

Step 9

Congratulations! You’ve successfully applied for the estate EIN. You can choose to have the EIN number given to you online in the form of a PDF document, or you can choose to have the EIN mailed to you. We always recommend choosing the PDF document option. Make sure to save the EIN PDF on your computer and to send a copy to your attorney.