A Florida Medicaid Qualified Income Trust is used when an individual has too much income to qualify for Medicaid. Currently the yearly Medicaid maximum an applicant for Florida nursing home Medicaid can have is $2,349 (2020) per month. If the applicant is even a penny or dollar over the $2,349 per month amount, then the applicant will be denied for Florida Medicaid.

One easy solution to fix this issue is to set up and fund a Qualified Income Trust—also known as a Miller Trust. So what in the world is a Qualified Income Trust?

Table of Contents

What Is A Qualified Income Trust?

A Qualified Income Trust (QIT) is a type of trust established by the federal code that allows an over income Medicaid applicant to qualify for Medicaid income wise. The Qualified Income Trust is typically drafted by a competent elder law attorney and then it is set up at a bank. The easiest way to think about a Qualified Income Trust is that it is a glorified bank account: the Medicaid applicant’s excess income goes into the Qualified Income Trust each month so that the Medicaid applicant now qualifies for Florida Medicaid income wise.

|

|

Here’s an example of how a Qualified Income Trust works here in Florida:

Jimbo is applying for Florida long term Medicaid because he needs to go to a nursing home. Jimbo’s gross monthly income is $3,000 per month between his pension and his social security. Jimbo is not qualified for Florida long term Medicaid because his $3,000 per month gross income exceeds the $2,349 per month allowed by Florida Medicaid.

In order for Jimbo to qualify for Florida long term Medicaid, his wife meets with a competent Florida elder law attorney and established a Qualified Income Trust. She sets up the Qualified Income Trust at a local bank and places $700 of Jimbo’s monthly income into the Qualified Income Trust. Jimbo is now qualified income wise for Florida Long term Medicaid.

Caution: Never place an Medicaid applicant’s assets into a Qualified Income Trust. A Qualified Income Trust is set up to lower a Medicaid applicant’s income, not their assets. If the applicant dies and the Qualified Income Trust holds the applicant’s assets, the remaining assets will all be going to the State of Florida to pay back medical expenses.

Monthly income placed into the QIT can only be used for medical expenses of the Medicaid applicant during their lifetime. This means that distributions from the QIT other than for medical expenses can cause issues with the validity of the QIT.

Qualified Income Trust Example

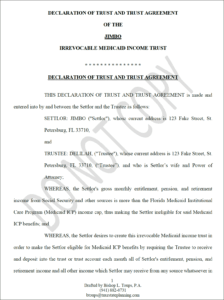

Here’s page one of what a Qualified Income Trust looks like:

Step by Step Guide on How to Set Up a Qualified Income Trust

So now that we know the basics of what a QIT is, it’s time to discuss how to properly set up a QIT. A QIT must be set up properly. Any error can cause the QIT to not be considered a QIT, which could be a very costly issue for the Medicaid applicant. Here’s a step by step guide on how to properly set up a QIT:

Step 1: The Qualified Income Trust Can Only be Established by Certain Individuals

The QIT can only be established by the Medicaid applicant, the applicant’s spouse, or the applicant’s legal representative (e.g. Power of Attorney). If established under a Power of Attorney, the Power of Attorney document must both give the Power of Attorney the ability to create a trust, and this power must be initialed next to. The QIT should be drafted by a competent elder law attorney who practices Medicaid Planning.

If a Power of Attorney is establishing the Qualified Income Trust in Florida, the Department of Children and Families (DCF)—the agency that approves or denies Medicaid applications—will require that the Power of Attorney authorizes the Agent under the Power of Attorney to create an inter vivos trust. Additionally, the power granting the Agent under the Power of Attorney the ability to create an inter vivos trust must be initialed next to by the creator of the Power of Attorney. This is why it’s vitally important that you update your Power of Attorney if your Power of Attorney was created outside the State of Florida, was created before 2011, or is a cookie cutter Power of Attorney found off the internet.

Note: If the Medicaid applicant no longer has capacity and the Power of Attorney does not authorize the ability to create an inter vivos trust, there is a way of still creating a QIT through a pooled trust. Speak to a competent elder law attorney about this option before you try this.

Step 2: Opening the Trust Account

Once the QIT is drafted by a competent elder law attorney and is established by the Medicaid applicant, the applicant’s spouse, or the applicant’s legal representative (e.g. Power of Attorney), then the Trustee of the QIT must open a trust account with a local or national bank. The bank account will be the same name as defined in the QIT. The account should also be non-interest bearing and it should not have a service charge fee (although, it’s not the end of the world if it does have a service charge fee).

Some QIT trustees will try to establish a separate taxpayer identification number (EIN) for the QIT. This is incorrect. The QIT is not a separate entity requiring an EIN under the IRS regulations. The QIT should be established using the Medicaid applicant’s social security number.

Tip: We typically recommend using a national bank as national banks are much more familiar with establishing QITs.

Caution: Local banks may tell you that you need an EIN number when establishing a QIT. This is incorrect. Either find a new bank, find someone more knowledgeable with QITs at the bank, or have your elder law attorney speak to the bank.

Step 3: Funding the QIT

Properly funding the Qualified Income Trust properly is the most important part of setting up the QIT. If the funding is not done properly then the Medicaid applicant may be denied Medicaid benefits. There are two main ways of funding the QIT:

- Place only the amount the Medicaid applicant is over the $2,349 (2020) income limit; or

- Place all of the Medicaid applicant’s income into the QIT.

Example: Jimbo’s monthly income is $2,600 gross per month. Jimbo’s wife, Delilah, establishes a QIT on his behalf and deposits $300 per month into Jimbo’s QIT. By placing $300 of Jimbo’s income into the QIT per month Jimbo is now meets the Medicaid income qualifications.

Example #2: Jimbo’s monthly income is $2,600 gross per month. Instead of placing $300 per month into Jimbo’s QIT, Delilah places all of Jimbo’s monthly income of $2,600 per month into the QIT. By placing all of Jimbo’s monthly income into the QIT each month, Jimbo is guaranteed to never lose Medicaid benefits due to a miscalculation or fluctuation in income.

Whether you choose option one or option number two will likely be a decision you make with your elder law attorney. Our firm prefers option number two as income can sometimes fluctuate, there can be income that is not accounted for, or the actual income is miscalculated due to not having the actual gross income numbers.

Caution: There are situations where you do not want to place all of the Medicaid applicant’s income in the QIT. Please speak with a competent elder law attorney before you fund the QIT.

By placing all of the Medicaid applicant’s monthly gross income into the QIT, you will definitely know that error in calculating the Medicaid applicant’s income will not disqualify him or her from Medicaid (or cause them to lose benefits).

Tip: We recommend setting up an automatic deposit from the Medicaid applicant’s bank account for the designated amount that should be placed into the QIT each month. For example, if the Medicaid applicant’s social security goes into his or hers regular checking account, then there should be an automatic deposit to the QIT on the next business day. The automatic deposit will always make sure that the correct amount of income goes into the QIT.

Caution: Just one month of improper QIT funding can cause the Medicaid applicant to be denied or lose benefits. Make sure to speak with an elder law attorney before changing the monthly amount you place into the QIT.