A common question we get is what in the world is a Florida lady bird deed? A lady bird deed—also known as an enhanced life estate deed—is a type of deed that allows an individual to make sure that their property does not pass through probate to pass to their beneficiaries after death.

Table of Contents

Overview

A Lady Bird deed is increasing in popularity because it saves beneficiaries thousands of dollars in probate fees (and the headache of probate), and the lady bird deed is less expensive than setting up a trust. This one of several legal services that help govern how assets are handled upon passing.

This article will cover the following:

- The basics of the lady bird deed (link);

- why lady bird deeds are so popular;

- The downsides of using a lady bird deed; and

- Example language of a lady bird deed

How a Florida Lady Bird Deed Works

A lady bird deed is a great tool to make sure that your Florida property does not go through probate. The easiest way to explain a lady bird deed is that the lady bird deed gives the owner of the property a life estate in the property and a remainder interest to beneficiaries. The owner of the property is considered a life tenant, and the owner of the remainder interest is called remaindermen.

Example: Delores has heard of horror stories of Florida attorneys charging thousands of dollars to put property through probate. In order to avoid her homestead property going through probate she executes and records a lady bird deed for her property.

Delores retains a life estate in the property and she gives her two sons a remainder interest in her property. Upon Dolores’ death, her sons will record Dolores’ death certificate and Dolores’ property will automatically transfer to her sons. Dolores’ property will pass outside of probate and will save her son’s thousands of dollars in attorney fees.

The lady bird deed’s main function is to make sure that property does not pass through probate. It is similar to a pay on death form that you fill out at a bank account to make sure that your bank account does not go through probate.

Frequently Asked Questions

Lady Bird deeds are simple enough in concept but sometimes situations beg a bit more clarification. In the above example, there wasn’t mention of homestead consideration, estates, or consideration for property sales. Below are a few of the most common questions we get regarding lady bird deeds.

If I give myself a life estate in my property, can I still sell the property?

Yes. Even though you are giving yourself a life estate in your property, a Florida lady bird deed still allows you as the life estate holder to sell the property without the remaindermen’s permission. This means that the life estate holder can do whatever they want with the property at any time despite only being a life tenant.

Example: Delores executed a lady bird deed and named her two sons as the remainder beneficiaries. Delores decided a few months after executing the lady bird deed that she no longer wanted to live on the busiest street in Sarasota. She put her property up for sale and sold it two weeks later. She didn’t need her son’s permission to sell the property even though she only had a life estate interest in her property because she executed a lady bird deed.

Note: Delores did not need to notify any of her sons that she old the property even though she was only a life tenant.

Can You Change Beneficiaries Once a Florida Lady Bird Deed is Executed?

Yes. The life tenant can always change who the beneficiaries are by executing and recording a new lady bird deed. Also, the life tenant does not need to notify a remainder beneficiary if the life tenant removes them as a beneficiary.

Example: Delores and one of her sons had a falling out after a drama filled Thanksgiving. She decided to execute a new lady bird deed removing that son as a remainder beneficiary. Delores also did not need to notify her son that he was removed as a remainder beneficiary.

Caution: Florida lady bird deeds are not private documents once they are recorded in the public records. If Delores’ son were to look up her property on the property appraiser’s website, he would be able to see the most recent deed and see that he was removed as a beneficiary.

What is the Difference Between a Trust and a Florida Lady Bird Deed?

The first difference between a trust and a Florida lady bird deed is cost. A lady bird deed is significantly cheaper than a trust. The lady bird deed can be a very cost-efficient way of transferring property to beneficiaries without the property having to go through probate.

The trust and lady bird deed are also two completely different documents. A lady bird deed is just a deed that is executed and recorded. The lady bird deed stays with your property. That means if you sell your property, your lady bird deed no longer exists. If you then buy a new property, you’ll have to execute a new lady bird deed if you want your new property to avoid probate.

A trust on the other hand is a leaving, breathing document that stays with you as the creator and the manager (trustee) of the trust. If you purchase a new property, you just have the new property deeded to the trust.

The trust is also a testamentary document. The lady bird deed is not. A testamentary document means that with the trust you can include just about any distribution you would like in the trust. With a lady bird deed, you are extremely limited in how you can distribute your property upon death.

Example: Delores wants to make sure that if one of her two sons predeceases her that their one-half share of her Florida real property will pass to that deceased son’s children. Delores’ best option to achieve this goal is to draft and execute a trust. The trust would allow her to create provisions that would seamlessly transfer a deceased son’s share of the property to her then living grandchildren.

Note: A lady bird deed could also achieve the same goal as the above example. However, if Delores drafted her lady bird deed in this manner and one of her sons predeceased her, the deceased son’s remainder interest would likely vest in the property. This means that Delores would have significant title issues with her property.

Tip: If the trust is properly drafted it can protect the property for any of Delores’ sons if they have creditor issues, spousal issues, or are a spendthrift (bad with money). The lady bird deed is not a great option if one of your beneficiaries has creditor issues, spousal issues, or is a spendthrift since the interest in the property transfers immediately upon death.

Does a Florida Lady Bird Deed Preserve Homestead?

When you own property in Florida and treat the property as your primary residence, you receive two major benefits from making the property your homestead: (1) your homestead is protected from a vast majority of creditors; and (2) you receive tax benefits that help decrease the amount you pay in yearly property taxes.

Fortunately, your Florida homestead is preserved when you execute a lady bird deed (Fla. Stat. Ann. 196.031). This homestead protection will also pass to your remainder beneficiaries if they are considered your heirs.

Example: Dolores decided to execute a lady bird deed for her Florida homestead by granting herself a life estate in her property and giving a remainder interest to her two sons. She retains her homestead benefits even though she only has a life estate in the property. Dolores then passes away in a terrible car accident where she was at fault. The driver of the other vehicle in the crash was the son of a famous personal injury attorney in her city. The personal injury attorney obtains a judgment against Dolores’ estate for a million dollars.

Result: Dolores’ homestead was preserved when she executed the lady bird deed. This homestead protection passed to her two sons when she passed. The personal injury attorney will be unable to recover any monies from Dolores’ homestead.

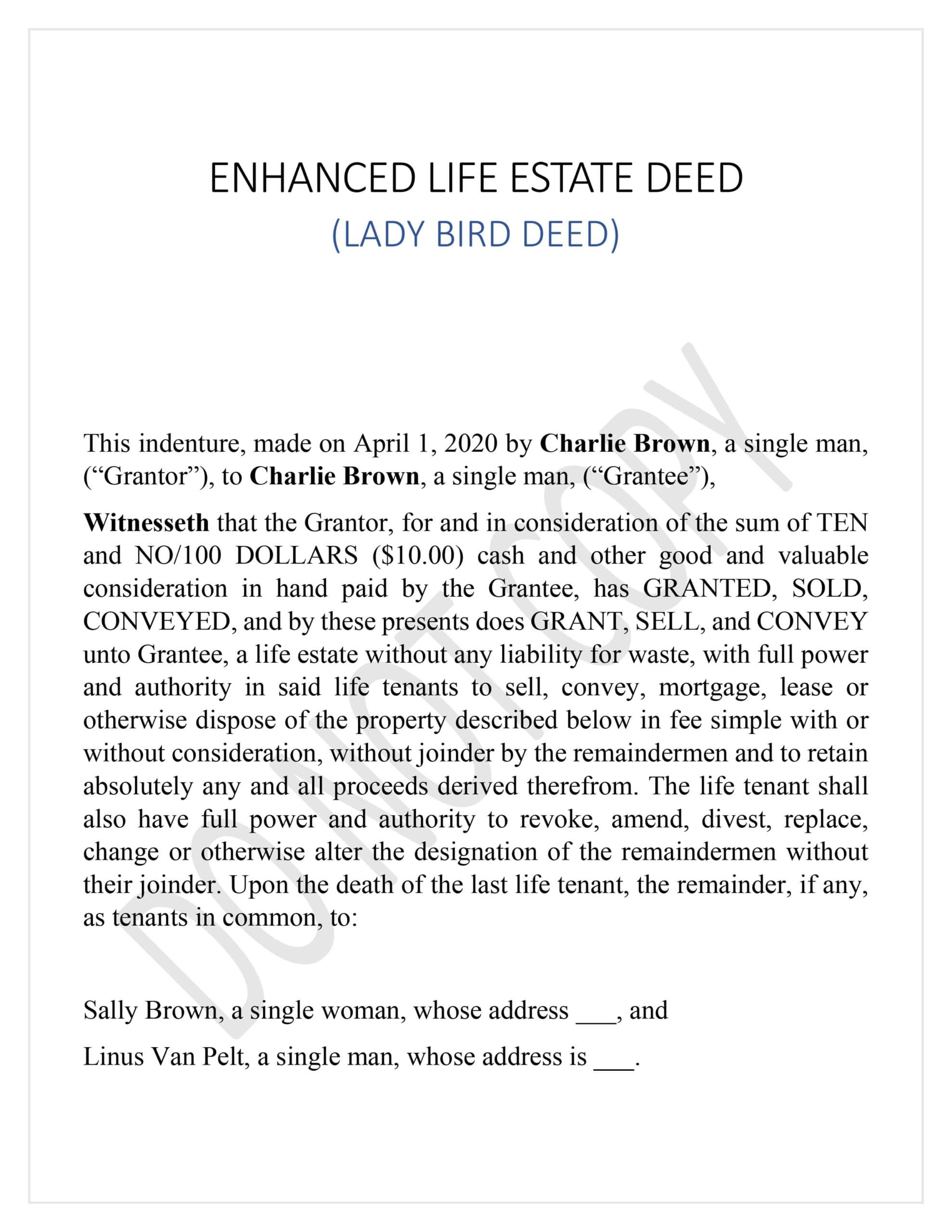

Sample Lady Bird Deed

Very Important Note: This is a very rough example of what a Florida lady bird deed looks like. We do not recommend using this document to try and draft your own lady bird deed. There is key language missing from the document that could cause title issues to your property if you try and use this example to draft your own lady bird deed.

Review

Lady Bird deeds offer a powerful means of convenience when setup properly. They can help address a number of situations and help avoid costly attorney fees and lengthly legal processes such as probate. If you have any further questions about lady bird deeds please don’t hesitate to contact one of our attorneys for a free consultation. We have several locations and our offices can put you in touch with a knowledgable attorney fast.