After notifying the IRS of your request to appeal, you will have anywhere from several months to a year before your hearing. It depends on the backlog at your IRS appeals office. Taking advantage of this time to prepare is essential.

Table of Contents

Overview

The months preceding an IRS appeal affords one invaluable planning time. This article details several key actions to take during the appeal process. Here’s a highlight:

- Review everything you presented to the auditor

- Get a copy of the auditor’s file by making your Freedom of Information Act request

- Study the file to see if the auditor misrepresented or missed something

- Read the text of any tax law cited by the auditor in the examination report and file to see if it really supports the stated position. If need be, check it out with a tax pro

- Re-review the examination report. Focus on the issues you need to combat

CAUTION

Don’t get bogged down in minor adjustment items—such as $54 of bank interest not reported on your return. Get to the heart of the problem that is costing you real money.

Organizing and Presenting Documents

Many audit battles are lost because the taxpayer didn’t get the appropriate records together. Jumbled papers or messy files may have caused the auditor to throw up his or her hands and show you the door.

Ask yourself if there are better ways to organize and present your supporting materials to the appeals officer.

For example, run adding machine tapes for each category of deduction, prepare schedules of items, or type up summaries and written explanations, point by point.

Get creative! Maybe something else tells your story better than words alone. Charts, graphs, and drawings are very effective.

EXAMPLE:

A part-time jazz artist’s deductions for his musical business were disallowed when the auditor concluded that his music was a hobby. So they brought a demo tape and player to an appeals hearing.

A picture is worth a thousand words. A photo of your professional-looking home office or a group shot at your business’s employee picnic may prove your deduction and win over an appeals officer.

Everyone prefers images over written descriptions or oral explanations—appeals officers included.

If neatness, typing, preparing schedules, or getting paperwork together is not your forte, find a bookkeeper or friend to do it. The expense is tax deductible.

Filling In the Gaps

If any of your records were missing at the audit, try harder to find them. Look back at every location where you might have put your papers.

Renew attempts to get copies of checks from banks and duplicate receipts from businesses and people with whom you dealt.

If you can’t get the documents, reconstruct missing items.

Focusing on Challenged Items

Make a separate file, page, or folder for each item the auditor challenged that you dispute. Write a simple explanation next to each stating why the auditor was wrong.

EXAMPLE:

“This deduction of $395 was for a sales training course to help me get more listings for my sideline real estate business, and should be allowed as a business educational expense.”

Next, segregate the supporting documents you have—canceled checks, receipts, and whatever else—for each item you dispute. Group them with, or attach to each of, your explanations.

A three-ring binder with dividers for each challenged item is one of the best ways to organize your tax materials. Make a duplicate complete copy of the binder for the appeals officer. If you have only one or two disputed issues, and few documents, you can put it all in a file folder.

While you give your presentation at the hearing, the officer can follow along. If you lose the appeal, the binder or file folder will do double duty if you go on to court.

Finding New Evidence

Think hard. Can you come up with anything new since the audit, such as a statement from someone familiar with a disallowed expense?

EXAMPLE:

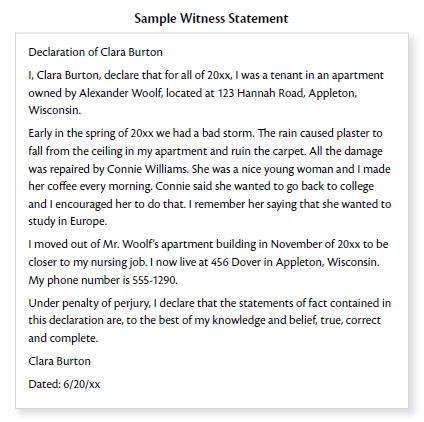

You hired Connie, a handyperson, to make repairs on your rental property. She didn’t have a bank account and insisted on being paid in cash. You couldn’t find the receipts for her labor and materials and she has since left town. Now, you could try to prove the work was done through a statement from a tenant, like the one below.

Did a real estate appraiser ever make a written report stating the value of the real estate? Can an appraiser do so now, based on sales of comparable properties that took place around the time of the donation?

Meeting the Appeals Officer

Before the hearing, prepare notes of what you are going to say to the appeals officer—an outline of the points you want to make. List the documents and other evidence you want to present. Then try it out by explaining your case to your friends or relatives. Ask if they understand it clearly. Their responses may direct you to weaknesses that you can work on before the hearing.

You’ll meet at the appeals office in a private office or meeting room. Seldom is anyone else present from the IRS. An appeals hearing is rather informal, so be yourself. Unlike a court, testimony is not taken under oath and technical rules of evidence don’t apply. Tell your story like you would to a friend.

The IRS won’t tape-record the hearing. You have a right to, as long as you inform the appeals officer several days in advance—but taping serves no real purpose. It would likely make the appeals officer speak less candidly than he or she would otherwise, and reduce your chance of reaching any settlement. If you go on to court, you wouldn’t be allowed to play the tape to the judge anyway.

TIP

Ask to see the file. If you never received a copy of the auditor’s file, ask the appeals officer to show it to you. Take a few minutes to make sure that there isn’t anything in there you aren’t prepared for.

If there is something new, ask for a postponement. The appeals officer will understand that you were entitled to this information in response to your FOIA request and should grant you the postponement.