Try as you might, you couldn’t get the auditor to see things your way. In fact, you thought the examination report was downright un-American. You went to the auditor’s manager. But again, no luck. What’s next? A formal appeal within the IRS, that’s what. Fewer than one in ten audited taxpayers request a formal appeal, although many more should.

Appealing isn’t especially difficult or timeconsuming. Your chance of getting at least some tax reduction is great. You don’t have to hire a tax professional to appeal.

Table of Contents

Odds of Winning an Appeal

Auditors privately call the appeals office the “IRS’s gift shop.” There is even an IRS in-joke that appeals officers work on the 50% rule—they cut auditors’ adjustments by half. IRS statistics show that the auditors are exaggerating—but not by much. The typical appeal results in a 40% decrease in taxes, penalties, and interest proposed by the auditor.

While you don’t have an automatic right to appeal, the IRS normally allows it. In a few instances, you won’t be granted the right to appeal, such as if the 36-month deadline for completing the entire audit process has fewer than eight months left to it or you are deemed a tax protestor (someone who believes the income tax system is unconstitutional and refuses to pay taxes on that ground).

If the IRS does not grant an appeal, it will send you a 90-day letter, formally called a notice of deficiency. This means that the only way to challenge the audit without first paying the additional tax the IRS claims is owed is to go to tax court.

There are three good reasons for appealing, and two relatively insignificant reasons not to:

Pros

• Appealing costs nothing unless you use a tax lawyer.

• Appealing, in the majority of cases, results in some tax savings—although rarely a total victory.

• Appealing delays your audit tax bill, buying you time to raise the cash.

Cons

• Interest and maybe penalties on the audit bill continue to run during an appeal. The amount is small, however, when compared with the likely tax savings from appealing.

• An appeals officer can raise issues that the auditor missed, but this almost never happens. Nevertheless, if you are afraid that something might pop up and you’ll owe a lot more in taxes, you can skip the appeal and go directly to tax court, where new issues can’t be raised. Before you skip the appeal, talk to a tax attorney. If you hire an attorney for tax court and win your case, you may be able to get your attorney’s fees paid by the IRS—but you must have appealed within the IRS first.

How to Appeal an Audit

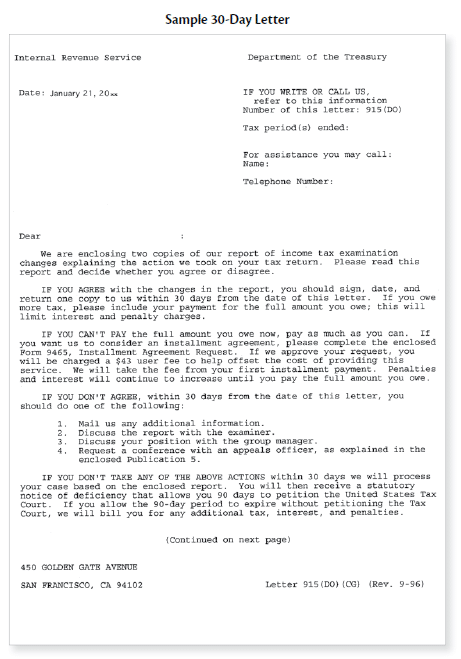

After your audit file is closed, the IRS sends an examination report with any proposed adjustments— additional taxes, penalties, and interest. If you don’t sign and return the report within a few weeks, the IRS usually sends a 30-day letter and Publication 5, Your Appeal Rights and How to Prepare a Protest If You Don’t Agree, explaining how to appeal. (Publication 5 is available on the IRS website at www.irs.gov.)

The official IRS term for appealing an IRS determination is “filing a protest.”

How to Start an Appeal

You must file your appeal—referred to by the IRS as a “protest”—within 30 days of the date on the 30-day letter, not the date you received it. You can, and usually should, appeal informally to the auditor’s manager.

Caution

Informally appealing—that is, contacting the auditor’s manager— does not extend the 30-day deadline to file a protest. Be sure to meet the deadline for filing your formal appeal even if you choose to continue the discussion with the manager or senior auditor.

Extension. If you can’t get your protest letter in within the 30-day deadline, request an extension from the auditor or manager. Extensions are usually granted, but don’t rely on a verbal promise. If the IRS has not sent you notice with the new deadline date, send your own letter stating the terms of the extension and the name of the person who granted it. Typical extensions are for 30–60 days.

The IRS has a preprinted form for audit protests—Form 12203 (see sample below). Use this form if the amount you are protesting is less than $25,000. Or, you can write a protest letter. If you owe under $2,500, you can orally request an appeal to the auditor. Even so, put it in writing.

Oddly enough, if the IRS sends you a 90-day letter with your examination report, thereby denying you the right to formally appeal, and you sue the IRS in tax court, your case will be sent to the appeals office before the tax court anyway. You will be offered a meeting with an appeals officer. Unless you are hell bound to meet a tax court judge, take the IRS up on the offer. If you still don’t settle, your case will be sent back to tax court.

For how to file the protest letter, click here.

Need help with your audit? Reach out to Daily & Toups for a free 15-minute consultation with one of our tax attorneys. We represent clients nationwide have been helping clients stand up to the IRS for over 40 years.