Would you like to wipe your tax slate clean at an enormous discount? The IRS has accepted less than 1% of a tax bill and called it even. There is no legal right to ever have a valid tax bill reduced by the IRS. It is entirely a matter of government discretion whether or not you qualify for an Offer in Compromise—referred to as an Offer or an OIC.

In all but a few instances, the IRS must give a properly submitted OIC its fair consideration. You even have the right to take a rejected OIC to the IRS Appeals Office. This step by step guide will provide you will a complete guide to filling out an OIC.

Table of Contents

Introduction

The majority of OICs are initially rejected. We strongly recommend reaching out to a competent tax attorney if you have any questions. Submitting a well put together OIC can be both difficult and stressful.

It can also take many months before you hear from the IRS about your OIC. If your OIC is not well put together, then your OIC will be denied after many months of waiting. And you will be back to square one.

WARNING: You should always be wary of who you hire to prepare your OIC. There are many fly by night IRS tax debt relief companies that will promise you the world. They will charge you many thousands of dollars to prepare your OIC even if the odds of your OIC being accepted are very low. Then when your OIC is denied you will hear excuse after excuse as to why the OIC was denied.

What is an Offer in Compromise?

An offer in compromise (OIC) is an agreement between a taxpayer and the Internal Revenue Service (IRS). This agreement settles a taxpayer’s tax liabilities for less than the full amount owed. Taxpayers who can fully pay the liabilities through an installment agreement or by other means, generally won’t qualify for an OIC in most cases.

STEP 1

Before an offer can even be considered, a taxpayer must meet four requirements:

- the taxpayer must have filed all tax returns;

- the taxpayer must have received a bill for at least one tax debt included in the offer;

- the taxpayer must have made all required estimated tax payments for the current years; and

- the taxpayer must have made all required federal tax deposits for the current quarter if the taxpayer is a business owner with employees.

CAUTION

If you did not file all of your tax returns and you submit an OIC, the OIC will be returned by the IRS and the initial payment that must be sent with the OIC will be applied to your current tax liability.

STEP 2

The next step is to figure out under which grounds the IRS will accept your OIC. There are three grounds that the IRS may use to accept an OIC:

- Doubt as to Liability. There is some doubt as to whether you owe the tax bill. This condition is unusual and should only be claimed after talking to a tax pro. See the note below.

- Doubt as to Collectibility. There is some doubt as to whether the IRS can ever collect the tax bill from you–now or in the foreseeable future.

- Effective Tax Administration. You have sufficient assets to pay in full but, due to exceptional circumstances, payment would cause an “economic hardship” or would be “unfair” or “inequitable.”

CAUTION: You cannot submit an OIC if you are in bankruptcy, have an open audit with the IRS, or if there is an outstanding innocent spouse claim.

NOTE: If you are claiming that the IRS should accept your OIC on the grounds of Doubt as to Liability, then you must complete and submit Form 656-L. You can find the form on the IRS website, www.irs.gov. You are also not allowed to file both an OIC for Doubt as to Liability and an OIC for either Doubt as to Collectibility or Effective Tax Administration.

Step 3

If you have met both Step 1 and Step 2, congratulations. The fun is just getting started. The next step is to figure out your reasonable collection potential (RCP). In most cases, the IRS won’t accept an OIC unless the amount offered by a taxpayer is equal to or greater than the RCP. Simply put, the RCP is how the IRS measures the taxpayer’s ability to pay. The RCP includes the value of the taxpayer’s assets, such as real property, automobiles, bank accounts, and other property. The RCP also includes future income less basic living expenses. We will show you how to calculate your RCP in the following pages.

So you’ve met all three Steps — you are now ready to start filling out the OIC form 433-A. Use Form 433-A if you are an individual taxpayer or you operate a business as a sole proprietorship (this includes a disregarded single-member LLC).

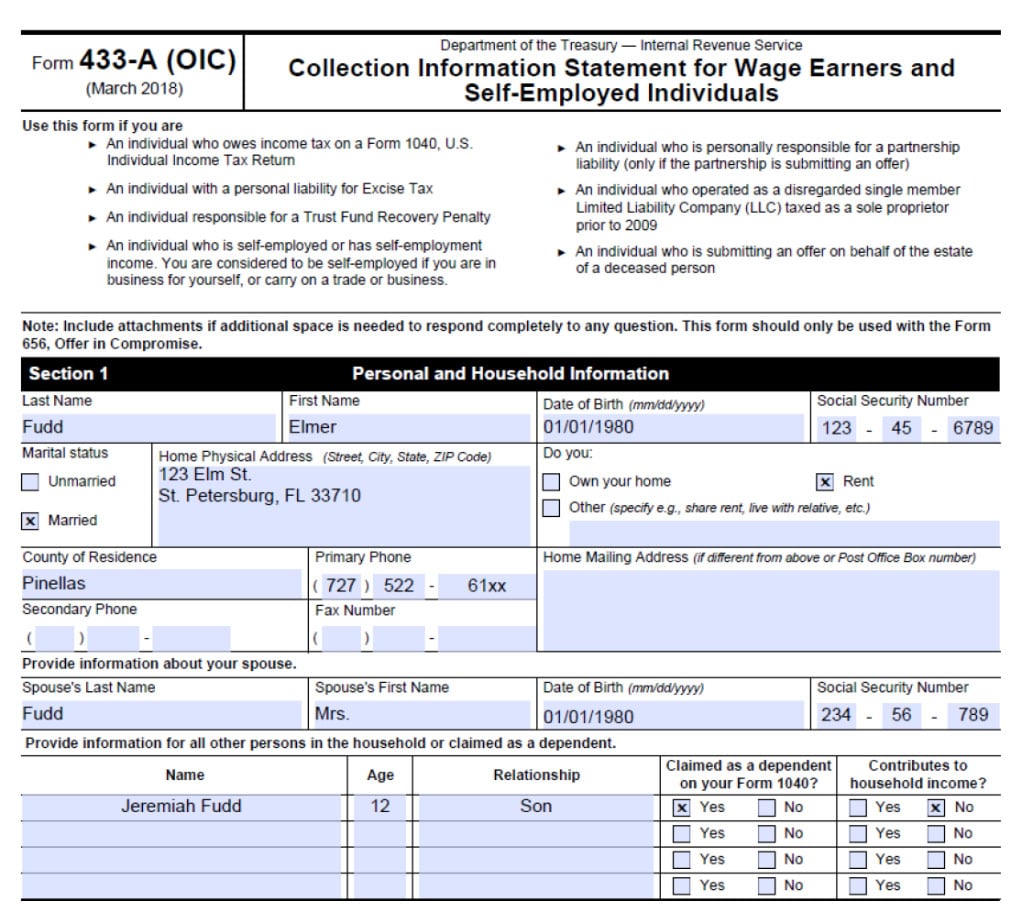

This guide will walk you through how to properly fill out a form 433-A using the following case study:

OIC Example Case

Elmer J. Fudd is married to Mrs. Fudd. They have one son, Jeremiah Fudd, who lives in their house and is too young to contribute to the household income. Elmer and Mrs. Fudd filed married filing jointly for 2015 when Elmer withdrew from his IRA early- -causing Elmer to owe the IRS $75,000.

Elmer and Mrs. Fudd do not have the ability to pay the IRS the $75,000 that is owed. Elmer finds out about OIC’s after reading this step by step guide on the Law Offices of Daily & Toups. Elmer and Mrs. Fudd have the following assets:

- A bank account at Looney Tunes Credit Union with a $150 in it;

- A 401(k) retirement account at Looney Tunes Financial worth $2,500;

- A 2010 Honda Accord; and

- A 2016 Ford Explorer.

Both Elmer and Mrs. Fudd currently work. This case study is from an actual client of the Law Offices of Daily & Toups. We were able to help reduce their total tax liability by over $70,000.

CAUTION: If you are a business and taxed as a Corporation or a Partnership, then you will need to fill out 433-B. 433-B is beyond the scope of this guide. If you have questions regarding filling out the 433-B, please reach out to us here.

Form 433-A: Collection Information Statement

Below is an example of how to fill out Form 433-A which is required before one can submit the form 656 Offer-in-Compromise. Continue reading for a step-by-step breakdown of what needs to be filled in and what information needs to be used.

Section 1: Personal and Household Information

Let’s start with Section 1 of the 433-A. Here you will fill out all of your personal information. Very self-explanatory. If the tax liability you are looking to reduce with the OIC is a joint debt between you and your spouse due to the two of you filing married filing jointly, then fill in your primary spouse’s social security number. If the tax liability is not a joint liability between you and your spouse, then fill in your social security number.

If your tax liability is not a joint liability between you and your spouse, then the OIC calculation for household expenses will be much different than if the tax liability is a joint liability. Contact us here if this applies to you.

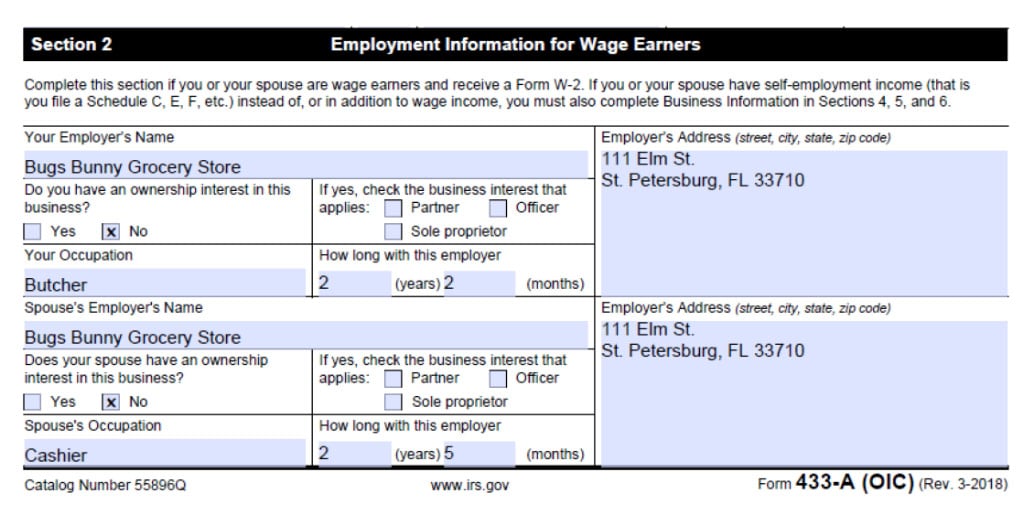

Section 2: Employment Information

Here, Elmer and Mrs. Fudd are both not self-employed nor do they have an ownership interest in the grocery store. If you are self-employed or have an ownership interest in the business that you are employed by, then be careful when filling out the 433-A. The 433-A may either not apply to you, or if the 433-A does apply to you, then the 433-A will likely be much more difficult to fill out.

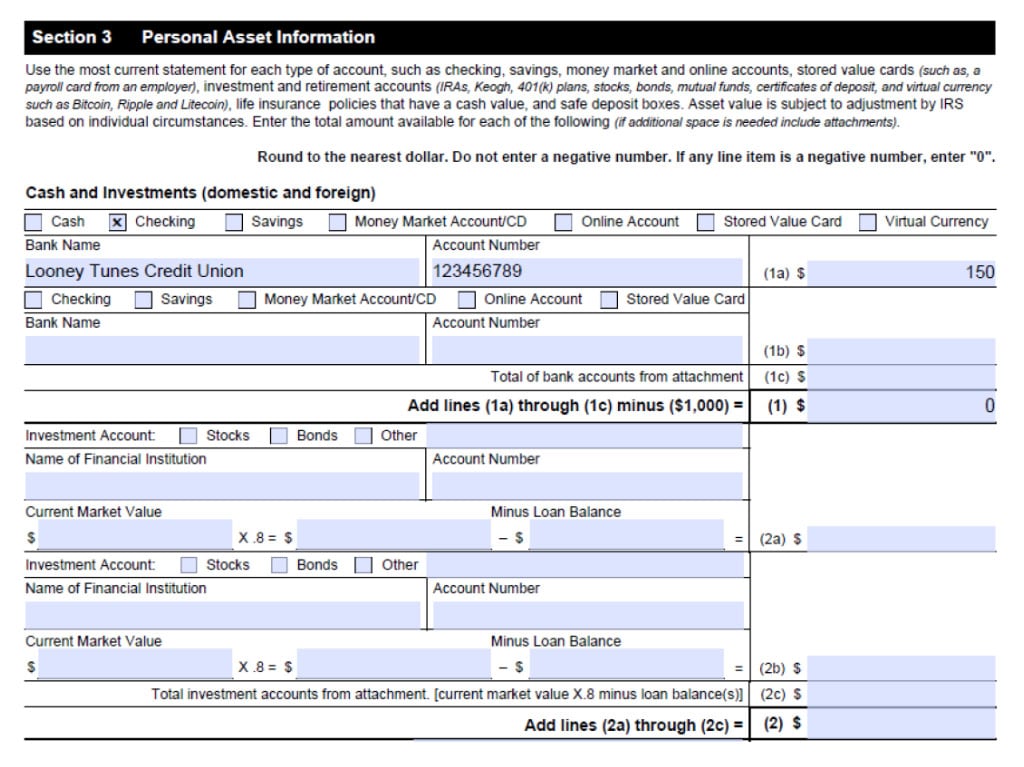

Section 3: Personal Assets

Make sure to accurately fill in your Cash and Investments. The IRS requires three months of the most recent bank statements when the OIC is submitted. The IRS will be able to tell if you are fibbing or if you have dissipated assets from your Cash and Investments.

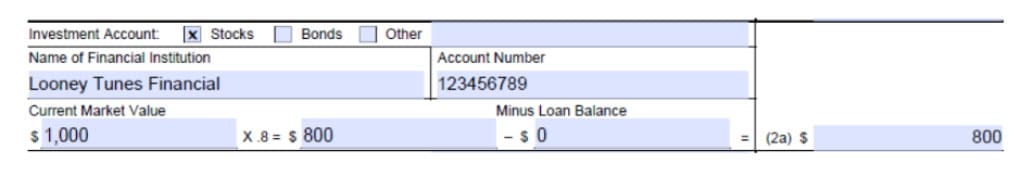

Investment Accounts

For investment accounts, you will fill out all of the required information and you will use the most current statement from the investment account for the value in the current market value boxes. Because investment accounts are not considered cash or cash equivalent accounts, the IRS allows for a 20% deduction in the current market value of the investment account. For example, if Elmer had a stock account with Looney Tunes Financial for $1,000, his market value box would look like this:

If there are any fees or penalties associated with early withdrawal or the withdrawal would cause an issue with your current tax year, then the value of your Investment Account may be lower.

If your stock is closely held–meaning that the company is not a publicly-traded company–then reach out to us here for help determining the value of the closely-held stock.

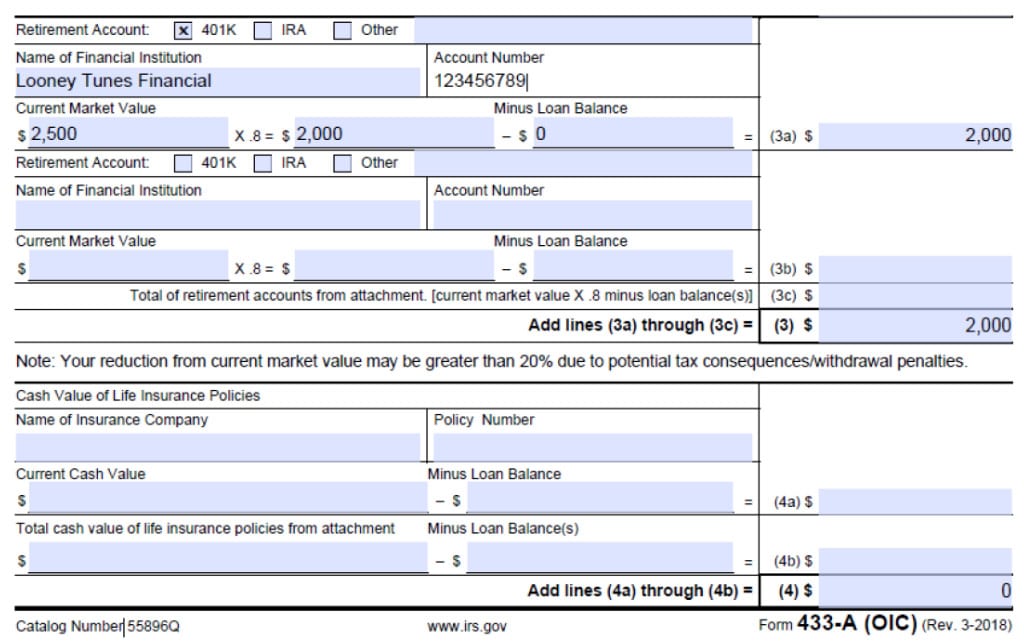

Retirement Account

You will fill out the Retirement Account and Cash Value of Life Insurance Policies sections similar to the Investment Account section. If you have an issue determining the current cash value of a life insurance policy, reach out to the company that holds the life insurance policy.

If your life insurance policy does not have a cash value, then you are in luck–you can fill out the section and place a zero for current cash value. Make sure to provide documentation that the life insurance policy does not have a cash value.

The value of your Retirement Account will depend on the following factors:

- Type of Retirement Account;

- Whether you are retired or close to retiring;

- Whether you have access to the retirement funds;

- Whether you can borrow or liquidate the Retirement Account; and

- Whether your Retirement Account includes a stock option.

Calculating the correct value of your Retirement Account can be quite complex and can make or break whether your offer is accepted. Speak with one of our tax attorneys for guidance.

Calculating the cash value depends on whether you plan on keeping the policy, selling the policy to fund the offer amount, or borrowing against the policy to fund the offer amount. If you need help calculating the value of your life insurance policy one of our attorneys can help.

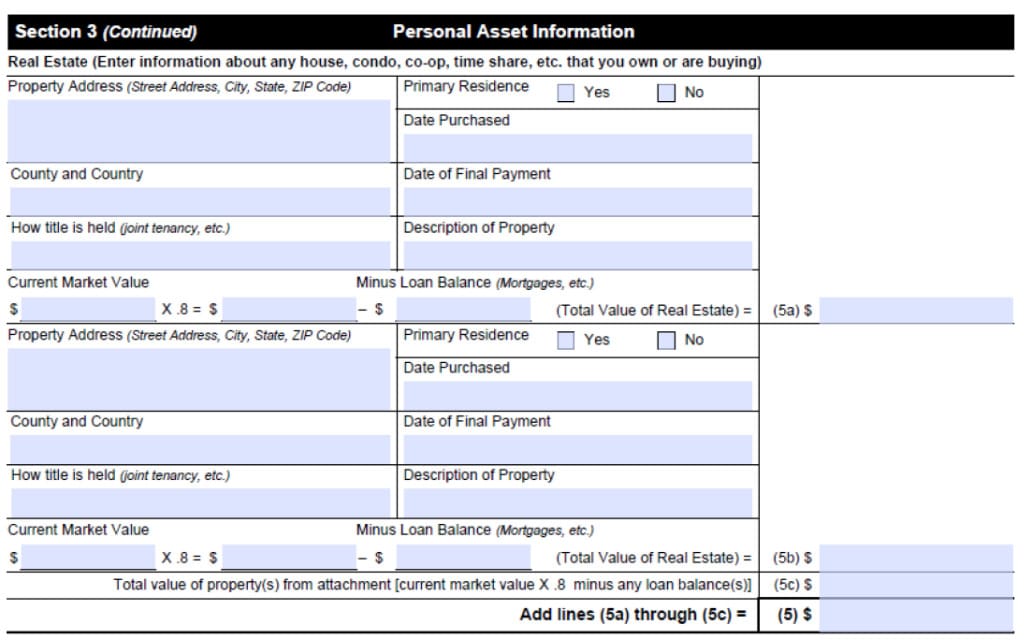

Real Estate Assets

For Real Estate, you will fill out any house, co-op, timeshare that you own or are buying. Determining the Current Market Value can be tricky–you do not need to go and get a formal appraisal, but you need to provide sufficient evidence to the IRS showing the Current Market Value you listed is reasonable.

The IRS defines the Current Market Value of the real estate to be the price at which a willing seller will sell and a willing buyer will pay. The IRS will use the following factors in determining whether or not the value you provide is reasonable:

- Accurint by LexisNexis

- Value listed on the real estate tax assessment

- Market comparable

- Recent purchase price

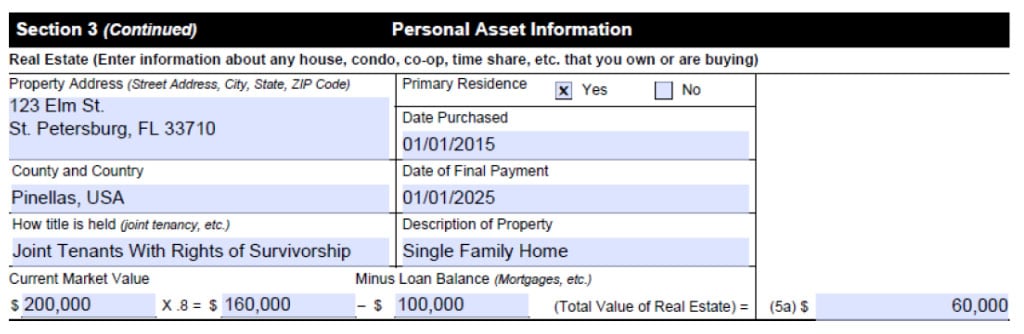

Once you determine the Current Market Value, make sure to reduce the value by 20% and then reduce that number by any mortgages. Here is an example:

In this example, Elmer and Mrs. Fudd used a recent property tax appraisal to determine the Current Market Value as $200,000. The $200,000 is then reduced by 20% and then further reduced by the mortgage balance of $100,000.

If you think the value of your Real Estate will prevent your OIC from being accepted, there are special circumstances where the IRS will not deny your OIC based on the value. For example, if a taxpayer has a Real Estate value of $20,000 and the taxpayer is both unable to borrow against the Real Estate and selling the Real Estate will cause a hardship (e.g. moving would prevent a disabled child from attending a specific school), then the Real Estate value may not be used to deny the OIC. This exception is case by case. If you have a question, speak to a tax pro.

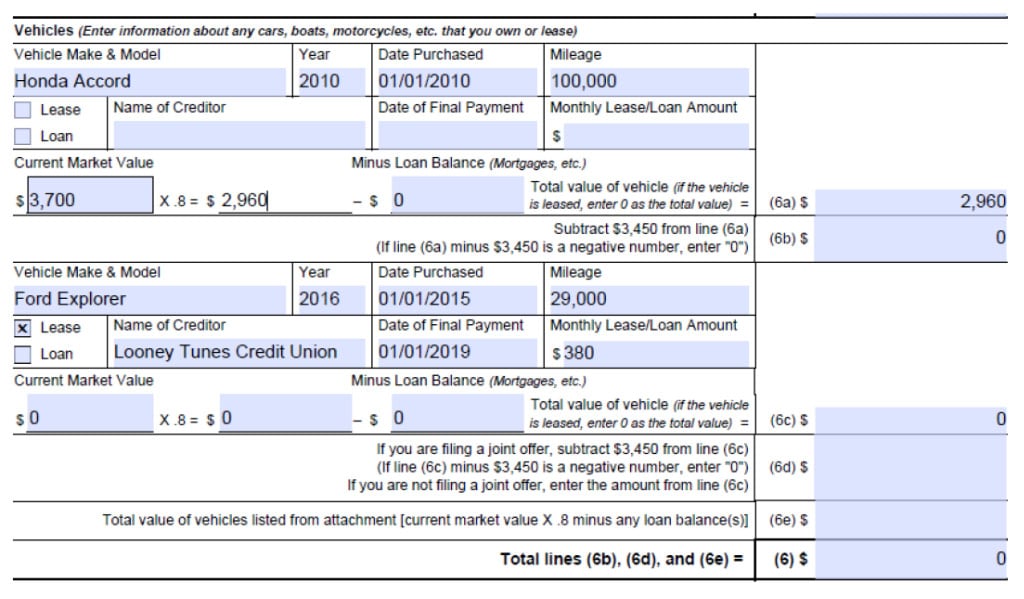

Vehicles

Fill in your Vehicle information–regardless of whether you own or lease the vehicle. If you lease the vehicle, then the value will be zero. If you own the vehicle, use a site like Kelley Blue Book (www.kbb.com) to approximate the value of your vehicle. The value does not need to be exact; the IRS will only ask for further proof of the fair market value of your vehicle if the value seems unreasonable.

In the example above, the value of Elmer’s 2010 Honda Accord’s is reduced by 20%. And since Elmer and Mrs. Fudd are filing a joint OIC, they can subtract $3,450 from the value of the Honda Accord–reducing the Honda Accord’s value to zero.

If you are not filing a joint return, you still may be able to reduce $3,450 from the value of a vehicle if the vehicle is used for work, the production of income, and/or the “welfare of the taxpayer’s family.” For joint OICs, $3,450 can be a deduction from two vehicles. For non-joint OICs, $3,450 can only be deducted from one vehicle.

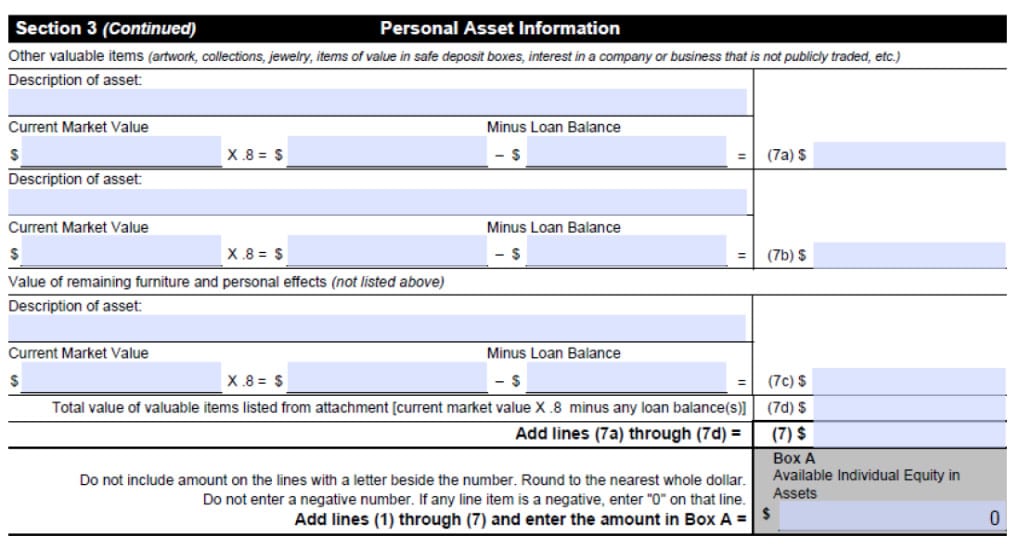

Personal Assets

For your Personal Asset Information, you can exclude most household property and personal effects, such as clothing, furniture, and appliances, as long as they are not luxurious. List luxury items like your sable coat and Louis XIV dining room set.

Unusual assets such as boats or airplanes may need an appraisal to determine the Current Market Value. Speak to a tax pro if you have a boat or airplane.

Sections 4-6

Sections 4 through 6 are beyond the scope of this guide. If you are self-employed or have business interests, then you should speak with a tax pro.

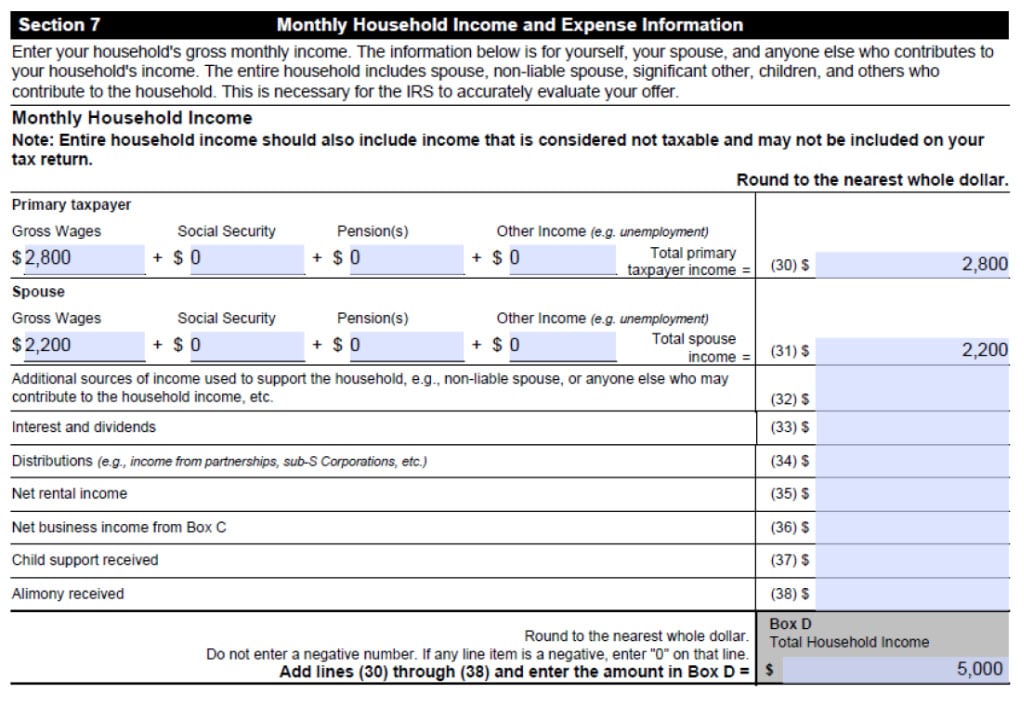

Section 7: Household Income & Expenses

For Monthly Household Income you will include your household’s monthly gross income–this means that anyone who contributes to the household’s income should be included here. Income is broad.

If you are unemployed, underemployed, close to retirement, or in poor health, speak to a tax pro. Your OIC income will depend on the circumstances of your situation and could determine whether your OIC is accepted or denied.

Monthly Household Income

Make sure your stated income is similar to your stated living expenses. The IRS will include the difference between income and your stated living expenses as income if your income is substantially lower than your living expenses.

If your income is expected to dramatically increase (e.g. you are going to graduate from medical school soon), then the IRS may seek to obtain a future income collateral agreement. If you have concerns about this, speak to a tax pro.

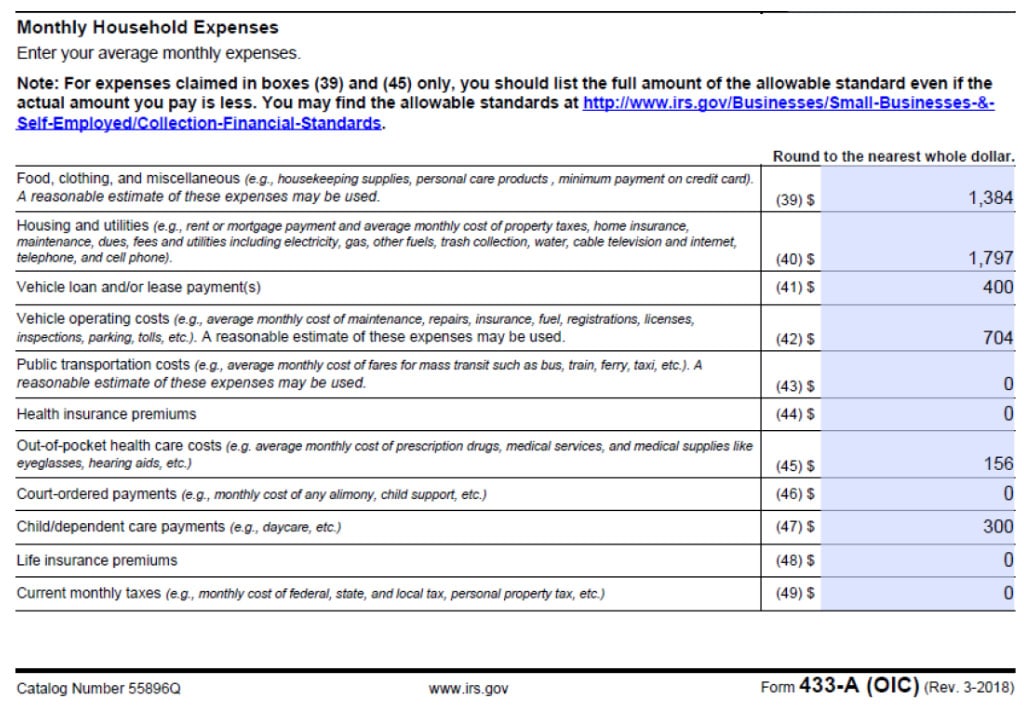

Monthly Household Expenses

Monthly Household Expenses are a very important part of filling out a proper OIC. This section can make or break your offer if it is not done properly. Some of the sections will have a zero for the monthly expense. This is because our case study of Elmer and Mrs. Fudd does not include certain facts. Your situation may not be similar, so read the guide closely.

We will take you step-by-step so that your calculations are correct. For this section, you will primarily use the National Standard Expenses published by the IRS each year. You can find the National Standard Expenses here. We do not advise you to go above the National Standard Expenses unless you provide documentation to substantiate why you should be allowed to go above–we find that the IRS rarely allows expenses above the National Standard.

Food, clothing, and misc

For Food, Clothing, and Miscellaneous we will use the National Standards found here. Since Elmer and Mrs. Fudd have a household of three, we will the three-person National Standard of $1,384.

Housing and Utilities

For Housing and Utilities, we will use the Local Standard found here. Since Elmer and Mrs. Fudd live in Pinellas County, Florida. The Housing and Utility Local Standard for a family of 3 is $1,797.

Vehicle Loan and/or Lease Payments

For Vehicle Loan and/or Lease Payments, you will use whatever you pay on a monthly basis for your vehicle loan or lease. Remember, this number will need to be substantiated with the right documentation.

Vehicle Operating Costs

For Vehicle Operating Costs, we will use the National Standard found here. Since Elmer and Mrs. Fudd own two vehicles and Pinellas County is near Tampa, we will use the National Standard of $504.

TIP

A Step by Step Guide to Completing an IRS Offer in Compromise 22

The IRS allows for an additional $200 per vehicle to be added to the Vehicle Operating Costs if the vehicle is over eight years old or has a mileage of 100,000 or more. This is an often underused trick. Elmer and Mrs. Fudd can increase their Vehicle Operating Costs from $504 to $704 because their 2010 Honda Accord is both eight years old and has a mileage of 100,000 or more.

Public Transportation Costs

The national standard for public transportation costs is $217. We only recommend using the national public transportation standard if you do not have a vehicle.

Health Insurance Premiums

Include what you pay monthly for your health insurance premiums. Make sure to provide proof of your premiums when you submit your OIC. We have never seen the IRS deny valid health insurance premiums. Make sure you

don’t miss this low hanging fruit as most of us have some sort of health insurance premium.

Out-of-Pocket Health Care Costs

For Out-of-Pocket Health Care Costs, we will use the National Standard found here. Since Elmer and Mrs. Fudd have a household of three all under the age of 65, we will use $156 ($52 x 3).

Court-Ordered Payments

For Court-Ordered Payments, you will use whatever you pay on a monthly basis for child support of a natural child or a legally adopted child.

Child/Dependent Care Payments

For Child/Dependent Care Payments, you will use whatever you pay on a monthly basis for child care. Elmer and Mrs. Fudd spend $300 per month for Jeremiah’s child care, so we will use $300.

Life Insurance

As long as your life insurance does not have a cash value, it’s usually allowed to include your life insurance payments. Make sure to provide adequate proof.

Current Monthly Taxes

For Current Monthly Taxes, you will use whatever you pay on a monthly basis for your current monthly taxes. This includes federal, state, and local taxes.

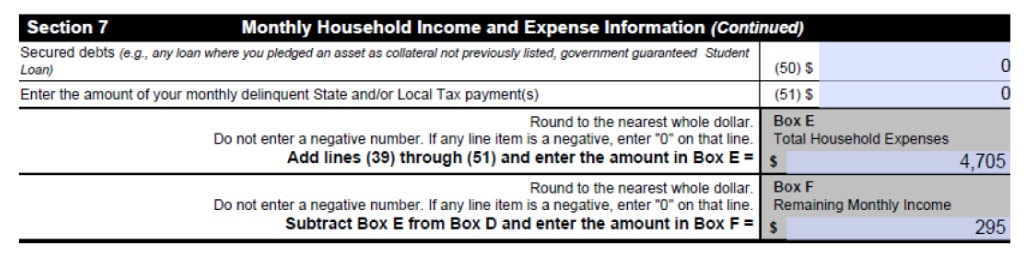

Secured Debts

For Secured Debts, you will use whatever you pay on a monthly basis for the repayment of a loan that is both secured and necessary for the health and welfare of the taxpayer or the taxpayer’s family. This includes both second mortgages on your home and student loans. If you have any questions about this section, speak to a tax pro.

CAUTION: Credit card payments are not secured debt. Be sure not to include this in the Secured Debt section. The miscellaneous allowance already includes credit card payments.

Delinquent state and/or local tax payments

If you have both delinquent federal and state or local taxes, then there are circumstances where you can include the monthly payments to state taxing authorities. Speak to a tax pro if you think this section applies to you.

CAUTION: If you claim an expense that is above a National or Local Standard, or the expense does not have a National or Local Standard, then you must sufficiently substantiate the expense when you submit your OIC. If you do not sufficiently substantiate the expense, the expense will be denied.

Section 8: Calculating the Minimum Offer

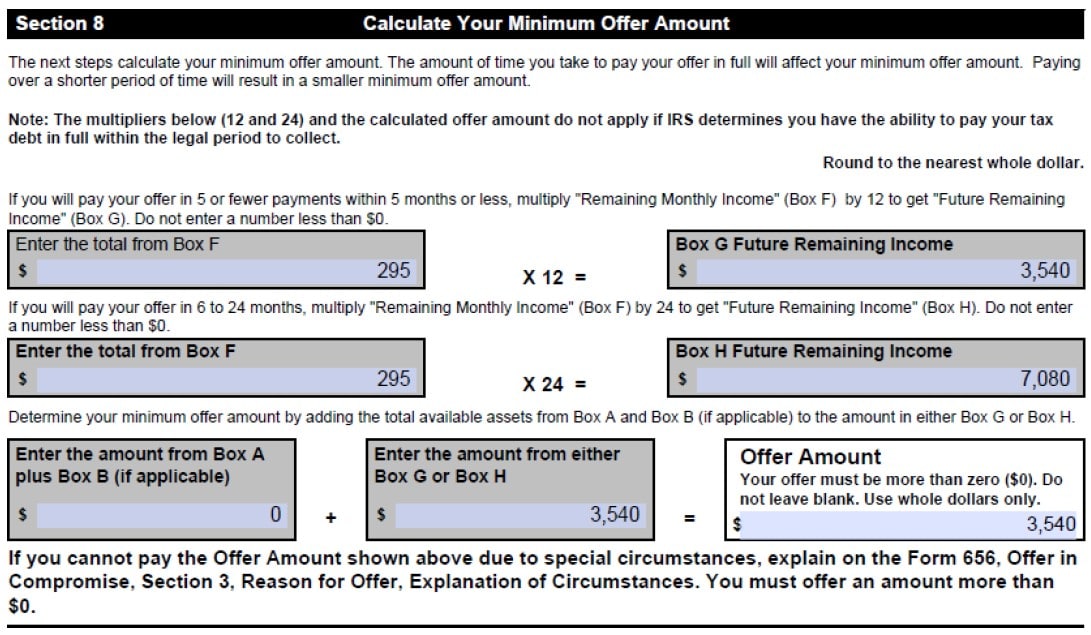

Now that we have figured out Elmer and Mrs. Fudd’s monthly household expenses, we simply add lines (39) through (51) and then enter that amount into Box E. Here, Box E comes out to $4,705. Once we have Box E, then we subtract Box D from Box E. Box D is the total household income found here. Since the total household income (Box D) is $5,000, we subtract $4,705 from $5,000 ($5,000 – $4,705), which comes out to $295. $295 is the remaining monthly income and we will use this number to calculate the OIC minimum offer amount in the next section.

After all of that hard work, we are finally ready to figure out the actual OIC minimum offer amount. Since Elmer and Mrs. Fudd’s remaining monthly income is $295 (Box F), we enter that number into both circled boxes. The first minimum offer amount–the absolute minimum the IRS will accept–can only be offered if you can pay the offer in 5 or fewer payments. This type of offer is called the lump sum option. Here, if Elmer and Mrs. Fudd can pay the offer in 5 or fewer months, then the minimum offer they can make to the IRS is $3,540 ($295 x 12 = $3,540).

If Elmer and Mrs. Fudd cannot pay the offer in 5 or fewer months, then they will have to make the maximum offer, which comes out to $7,080 ($295 x 24 = $7,080). This type of offer is called the periodic payment option. This would allow Elmer and Mrs. Fudd to pay the offer within 6 to 24 months. Since Elmer and Mrs. Fudd can pay the offer within 5 or fewer payments, they can make the minimum offer of $3,540.

CAUTION: If your tax liability is recent, the IRS can increase the amount owed by increasing the monthly payments by up to 60 months if the IRS still has 60 months remaining to collect the amount owed.

CAUTION: If you cannot make the required monthly payments the IRS will void your offer and none of the payments will be refunded.

CAUTION: No one has the right to ever have a valid tax liability reduced. Making an offer is a legal right that the IRS must consider. However, the IRS has the complete discretion to accept or deny your offer. Recently the IRS has only accepted four out of every ten OIC offers–and most of these accepted offers were initially denied.

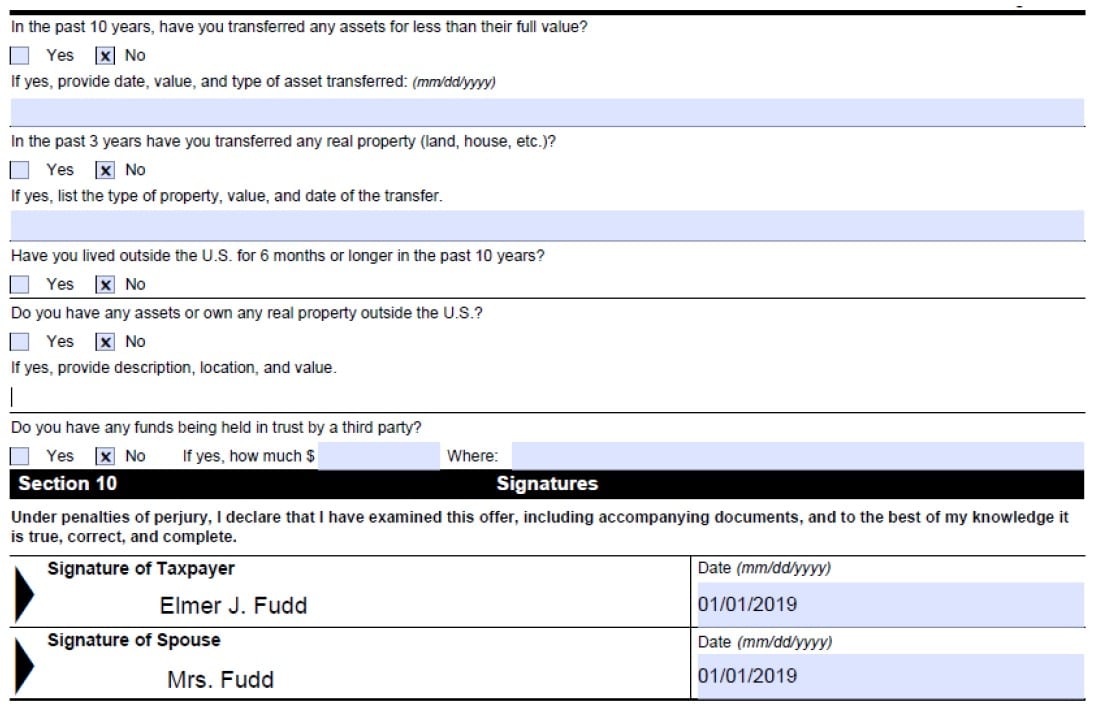

Section 9 & 10: Assertions & Signatures

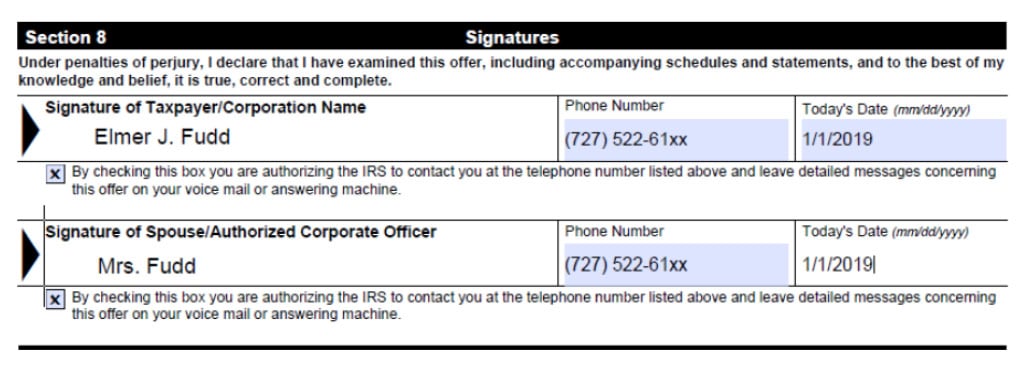

After finishing the minimum offer amount in Section 8, the next step is to fill out Sections 9 and 10. Make sure to answer the questions in Section 9 honestly. Once these two sections are filled out and Section 10 is signed, you are now done with the first–and the most difficult–form of the OIC. Remember, this form is called the 433- A. The next form that needs to be completed is the 656.

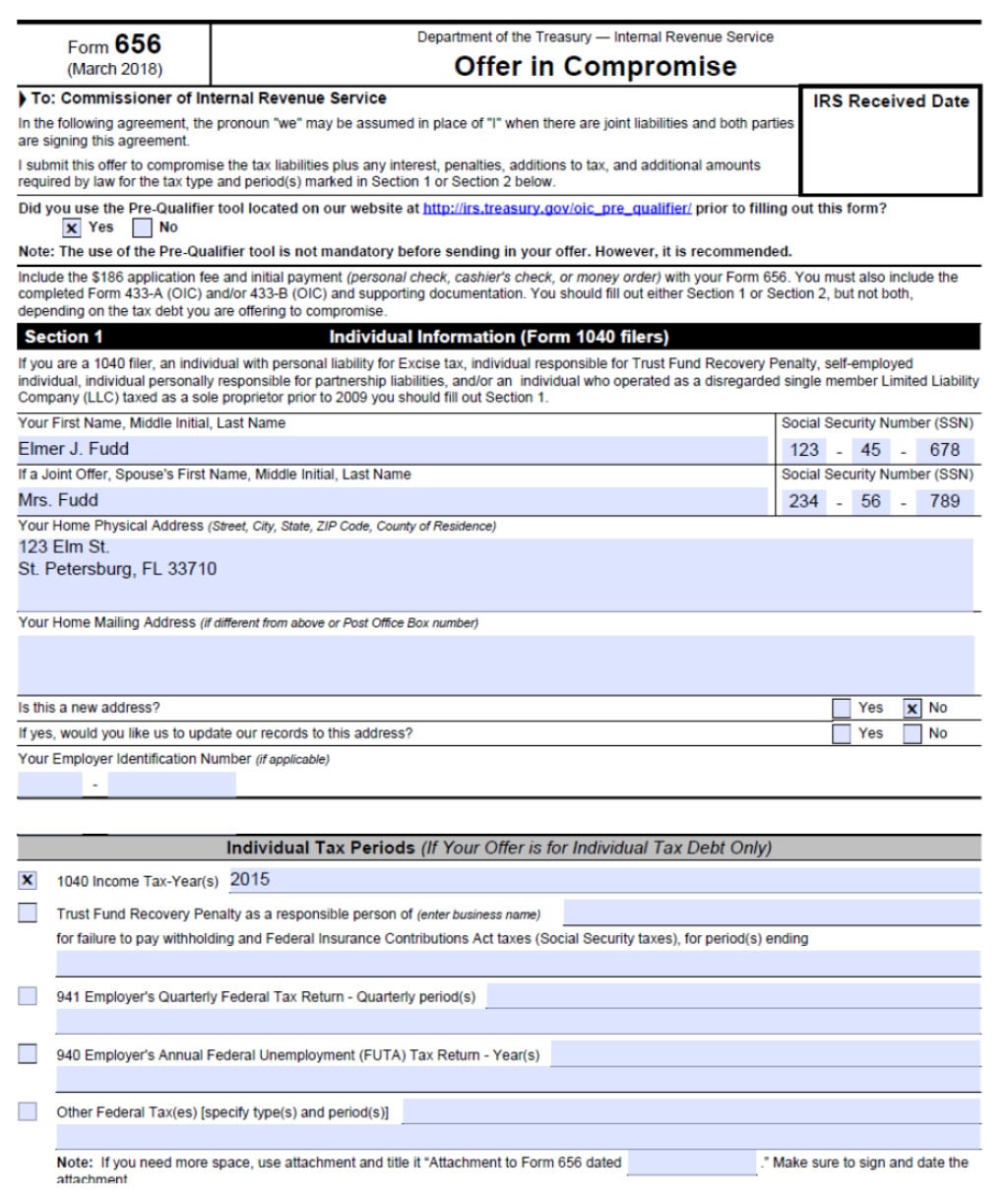

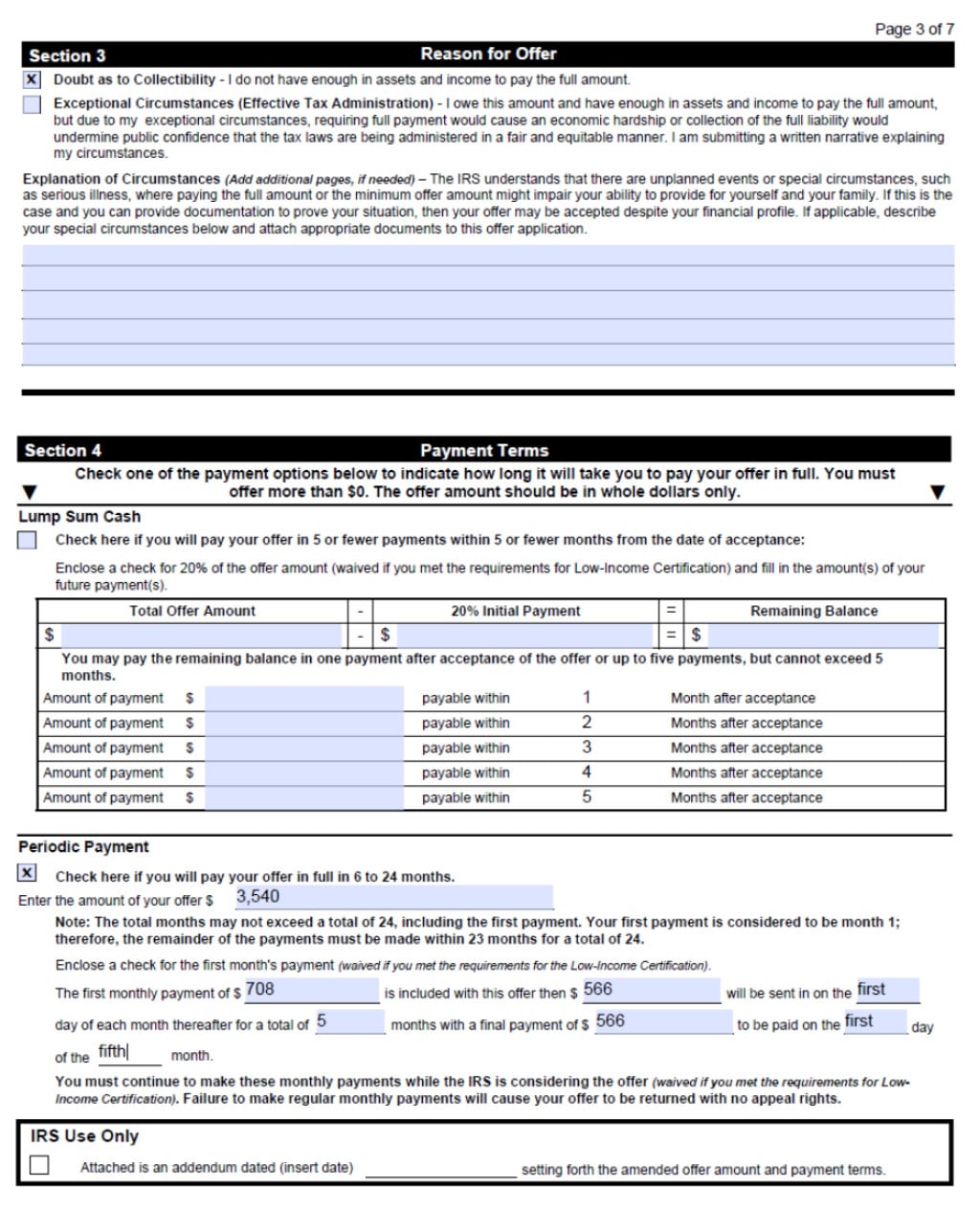

Form 656: Offer in Compromise

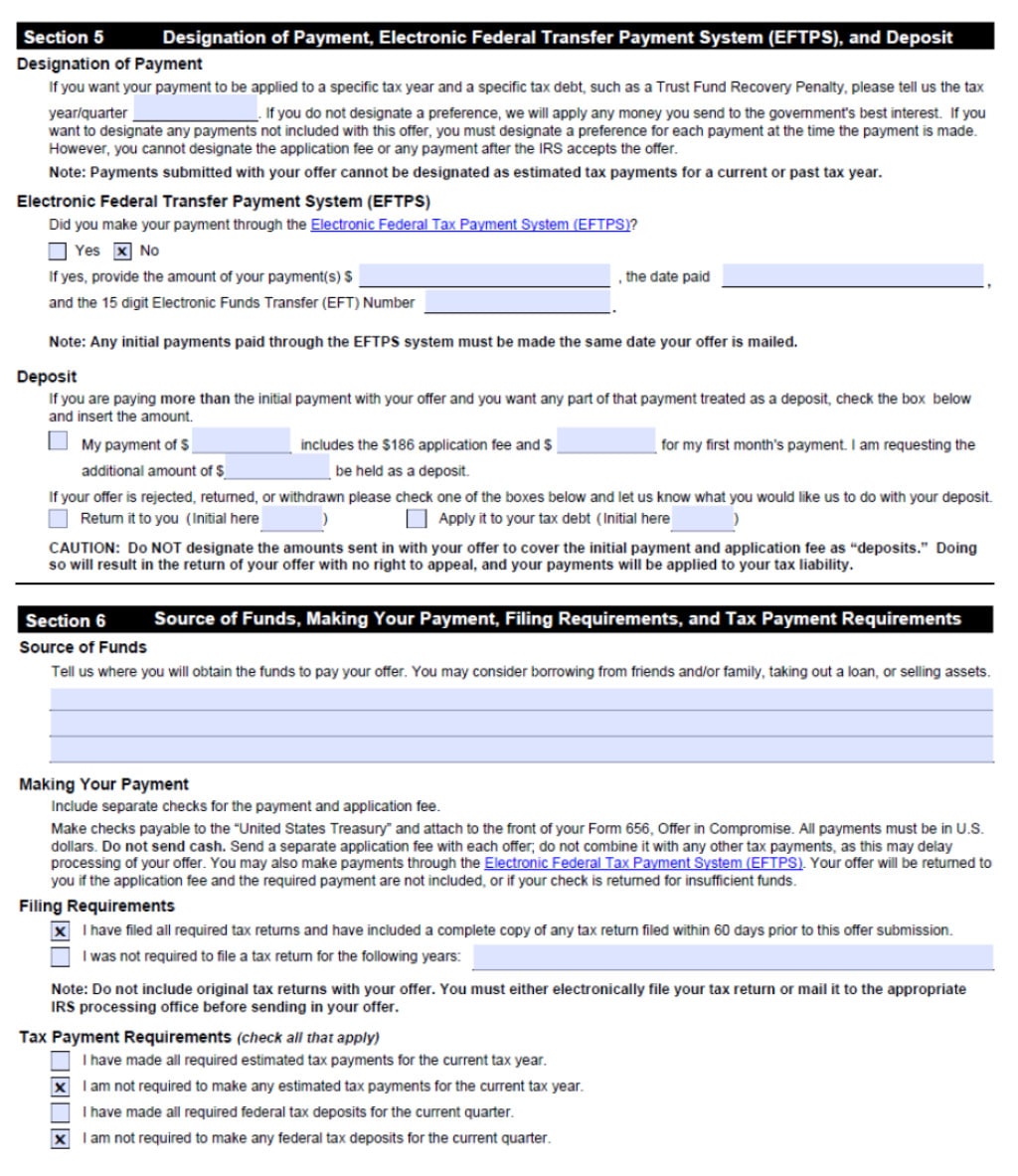

Form 656 is the formal offer made to the IRS. This must be included with your 433-A form with your $186 application fee. Because form 656 is relatively straightforward, we will just include what a properly filled out form 656 looks like using Elmer and Mrs. Fudd as an example.

Section 1: Taxpayer Information

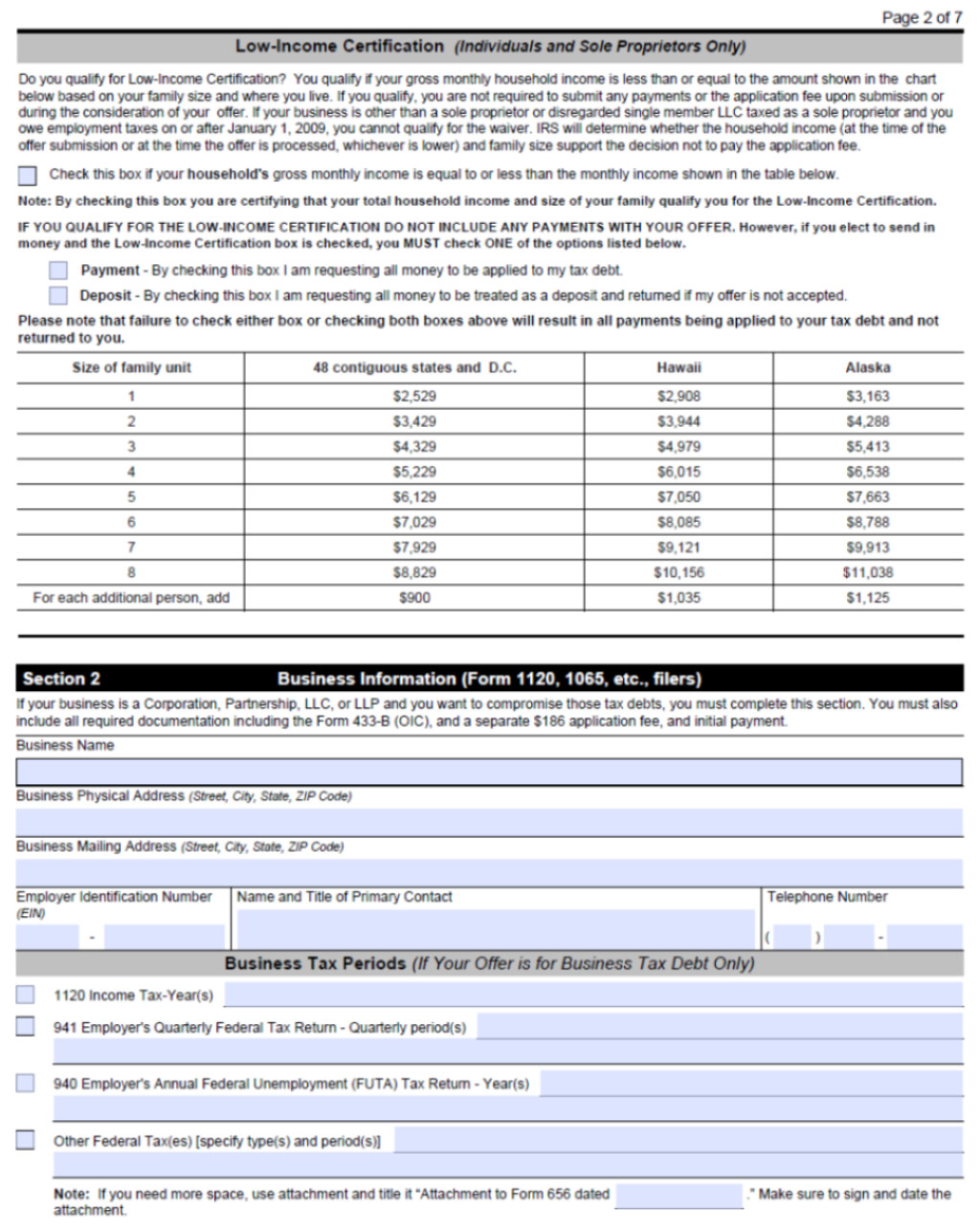

Section 1 cont’d & 2: Income Certification & Business Info

Sections 3 & 4: Reasons & Payment Terms

Since Elmer and Mrs. Fudd chose the lump sum option, they must include 20% of the offer amount within the initial offer–$708. If the offer is accepted, then Elmer and Mrs. Fudd will have to make five monthly payments of $566 to finish paying off the accepted offer.

Section 5, 6, & 8: Payments, Funds, and Signatures

It is perfectly fine to use loans or gifts from friends or family members to help pay for the offer. Just make sure you document where you are getting the funds from.

Offer in Compromise Frequently Asked Questions

What are my OIC payment options?

There are two payment options when you submit an OIC: (1) the lump sum option and (2) the periodic payment option. The lump-sum option requires 20% of the offer amount to be paid with the initial offer form. If the OIC offer is accepted, then the remaining 80% must be paid within five months after you receive notice the IRS accepted your offer. The periodic payment option requires an initial payment to be made with the OIC offer, and then the remaining payments must be made within six to 24 months if the OIC offer is accepted.

Can I see OICs that the IRS has accepted?

Yes, OICs that have been accepted are available for public inspection for one year after they have been accepted. You can review the OICs by visiting one of the seven IRS regional offices. Call the IRS at 800-829-1040 to find out where you can go to make an appointment.

Would offering more than the minimum amount increase my chances of the IRS accepting my OIC?

No. The IRS wants you to follow all of the OIC form directions.

Do I need to include workers’ compensation and unemployment benefits when filling out my monthly household income for the OIC?

No. Both workers’ compensation and unemployment benefits are excluded from your monthly household income.

If my offer is accepted, will the IRS not file a lien?

The IRS will still have the discretion on whether or not to file a Notice of Federal Tax Lien.

What if I have too many assets to qualify for an OIC?

If you have too many assets and think you won’t qualify for the an OIC, the IRS may accept your OIC offer if your offer meets the effective tax administration (ETA) exception. This exception is used when taxpayers have exceptional circumstances, such as advanced age, serious health problems, and physical and psychological infirmities. These exceptional circumstances must show that liquidating your assets would cause economic hardship for you or your dependents. If you think you might qualify for an ETA exception, speak to a tax pro.

If I pay a tax pro to do my OIC, how much does it cost?

A tax pro will charge anywhere from $1,500 to $7,500 for representation. Another option is to pay a tax pro for their time to review your OIC packet before it is submitted.

If my OIC offer is accepted, will the IRS suspend other collection methods?

Yes. Generally, the IRS will suspend any other collection alternatives (e.g. seizing your wages) if your OIC offer is accepted.

What happens if my OIC is rejected?

If your OIC offer is rejected, then the IRS will have more time to collect the tax liability since the statute of limitations is extended.

What happens if I don’t disclose all of my assets or income?

If you don’t disclose all of your assets or income and the IRS wises up after accepting your OIC offer, then the IRS may revoke your OIC.

What happens to my initial payment if my OIC offer is rejected?

If your OIC offer is rejected the initial payment will not be returned–it will be applied to your tax liability.

What happens after I send in my OIC offer?

After you send in your OIC offer, the IRS will initially look at your initial OIC offer application. If everything looks ok, the IRS will open a formal case and contact you directly, or it will assign the case to an IRS office near you for investigation.

What documents must be submitted for my OIC offer to be considered?

Form 656, 433-A or 433-B, $186 application fee, and the initial offer payment.

What documentation will I need to submit with my OIC offer?

- Copies of the most recent pay stub, earnings statement, etc., from each employer

- Copies of the most recent statement for each investment and retirement account

- Copies of the most recent statement from all other sources of income such as pensions, Social Security, rental income, interest and dividends, court order for child support, alimony, and rent subsidies

- Copies of bank statements for the three most recent months

- Copies of the most recent statement from lender(s) on loans such as mortgages, second mortgages, vehicles showing monthly payments, loan payoffs, and balances

- Verification of delinquent State/Local tax Liability, if applicable

What happens if my OIC offer is rejected?

The IRS must provide you with a written explanation if your OIC offer is rejected. If you wish to contest the rejection, you can formally appeal the rejection administratively. This appeal is filed by filing IRS Form 13711 and must be filed within 30 days of receiving the rejection. We recommend speaking with a tax pro before filing an appeal.

Can I file another OIC offer if my first offer is rejected?

Yes. You can submit another OIC offer if your first offer is rejected. The second OIC offer must be significantly different than your original offer.