Entering a safe-deposit box after a loved one dies can be extremely difficult and frustrating. Many states seal the safe-deposit box after someone dies until a court order to open the box is produced. Florida does not seal safe-deposit boxes after someone dies, but the process can be complicated to enter the safe-deposit box after death here in Florida.

Table of Contents

What’s the First Step to Entering a Safe Deposit Box?

The first step is to see if the decedent added a joint lessee to the safe-deposit box. A joint lessee can access the safe-deposit box without a court order here in Florida.

Example: Delores passed away in Florida and left a safe-deposit box. Her children believe that Delores kept expensive jewelry in the box. Before Delores passed, she added one of her children as a co-lessee to the safe-deposit box.

Result: Since one of Delores’ children is a co-lessee, the child will have full access to the box without a court order.

Caution: often there are items in the safe-deposit box that were owned by the decedent rather than by the joint lessee. The Personal Representative should ensure that any items owned by the decedent are accounted for.

Petitioning the Court to Enter a Safe-Deposit Box in Florida

If there is no joint lessee on the safe-deposit box, then the only way to enter the decedent’s safe-deposit box is by petitioning the Florida Probate Court. Technically, Florida Statutes allow a Personal Representative who has been issued Letters of Administration to enter the safe-deposit box without a court order; however, many Judges in Florida will restrict a Personal Representative from entering a safe-deposit box without a separate court order. Many financial institutions will also require a separate court order.

If there is no co-lessee, a court order will be required to enter the box. The first step in obtaining a court order to enter the safe-deposit box is for the Personal Representative to Petition the court to open the safe-deposit box. The Petition has to be filed in a separate proceeding from the probate case.

Note: Florida statute 655.936(1) allows the Personal Representative to enter a safe-deposit box without a court order if the Personal Representative presents a certified copy of their letters of administration to the financial institution. The statute also allows the Personal Representative to remove any content owned by the Decedent. While the statutes allow the Personal Representative to access the safe-deposit box, every financial institution we have dealt with will require a separate court order to enter.

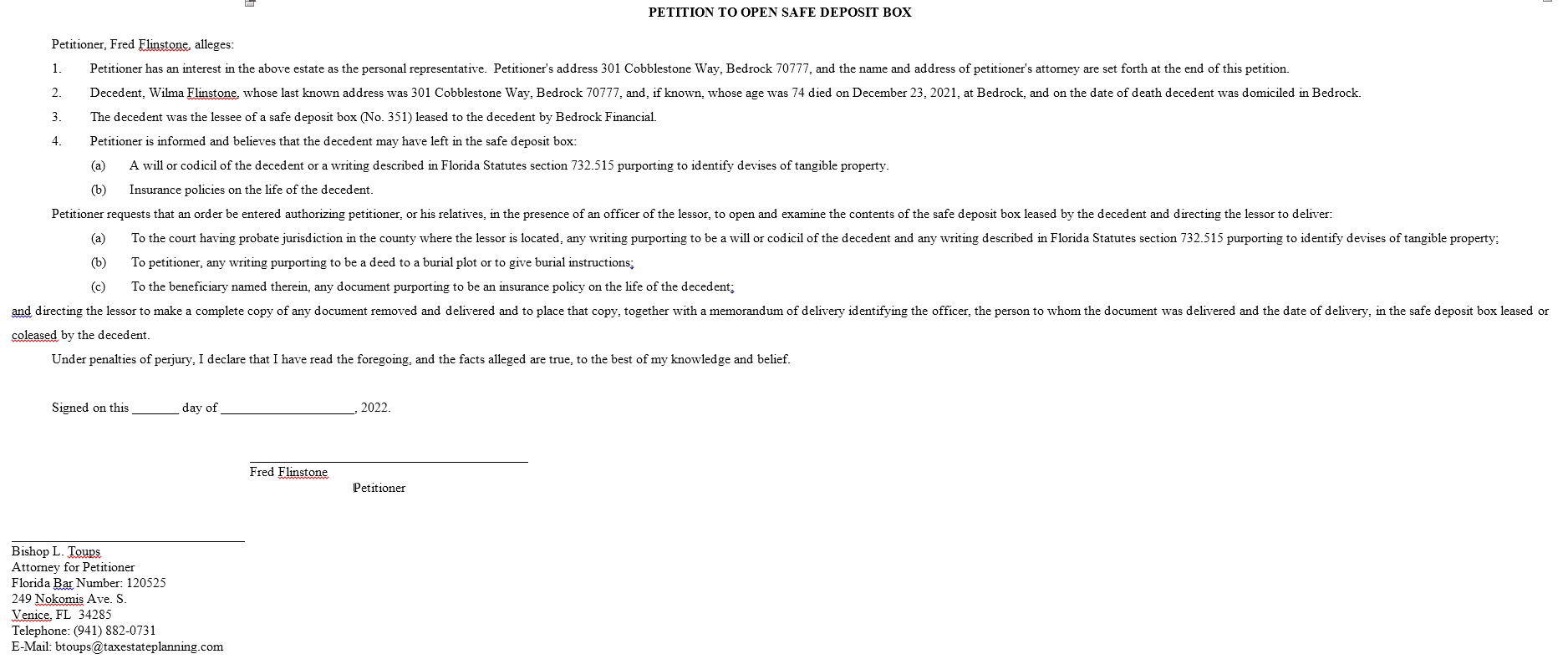

Example Petition to Open A Safe Deposit Box

This is an example petition letter to open a safe deposit box. On desktop, right click the image to open it in full size in a new tab. On mobile, tap and hold the image inside the border until you see a menu item saying “open image in new tab”.

We’ve also published the text from the example below.

PETITION TO OPEN SAFE DEPOSIT BOX

Petitioner, Fred Flinstone, alleges:

- Petitioner has an interest in the above estate as the personal representative. Petitioner’s address 301 Cobblestone Way, Bedrock 70777, and the name and address of petitioner’s attorney are set forth at the end of this petition.

- Decedent, Wilma Flinstone, whose last known address was 301 Cobblestone Way, Bedrock 70777, and, if known, whose age was 74 died on December 23, 2021, at Bedrock, and on the date of death decedent was domiciled in Bedrock.

- The decedent was the lessee of a safe deposit box (No. 351) leased to the decedent by Bedrock Financial.

- Petitioner is informed and believes that the decedent may have left in the safe deposit box:

- (a) A will or codicil of the decedent or a writing described in Florida Statutes section 732.515 purporting to identify devises of tangible property.

- (b) Insurance policies on the life of the decedent.

Petitioner requests that an order be entered authorizing petitioner, or his relatives, in the presence of an officer of the lessor, to open and examine the contents of the safe deposit box leased by the decedent and directing the lessor to deliver:

- (a) To the court having probate jurisdiction in the county where the lessor is located, any writing purporting to be a will or codicil of the decedent and any writing described in Florida Statutes section 732.515 purporting to identify devises of tangible property;

- (b) To petitioner, any writing purporting to be a deed to a burial plot or to give burial instructions;

- (c) To the beneficiary named therein, any document purporting to be an insurance policy on the life of the decedent;

and directing the lessor to make a complete copy of any document removed and delivered and to place that copy, together with a memorandum of delivery identifying the officer, the person to whom the document was delivered and the date of delivery, in the safe deposit box leased or coleased by the decedent.

Under penalties of perjury, I declare that I have read the foregoing, and the facts alleged are true, to the best of my knowledge and belief.

Signed on this _______ day of ____________________, 2022.

Fred Flinstone, Petitioner.

Bishop L. Toups

Attorney for Petitioner

Florida Bar Number: 120525

249 Nokomis Ave. S.

Venice, FL 34285

Telephone: (941) 882-0731

E-Mail: btoups@taxestateplanning.com

Entering the Safe-Deposit Box After Obtaining Court Order

Once the probate Judge in Florida signs off on the order allowing entrance to the safe-deposit box, the initial opening of a safe-deposit box must be conducted in the presence of any two of the following individuals:

- An employee of the institution where the box is located;

- The Personal Representative; or

- The Personal Representative’s attorney.

Once the safe-deposit box has been examined, an inventory of the contents of the box must be filed with the court within ten days after the opening of the box. The Personal Representative may also remove contents of the box belonging to the decedent.

Caution: If the box is co-leased, some items may belong to the co-lessee and may require further evaluation from the court as to who owns the items.