Taxpayer Interview

Auditors and revenue agents generate many of their questions for the audit from IRS Form 4700-A, Supplement and IRS Form 4700-B, Business Supplement.

You’ll do yourself well to read these well before your audit. They highlight the areas of inquiry you can expect.

If any item on these forms gives you real concern, see a tax pro before the audit or consider hiring a tax attorney to attend for you.

Information Document Request

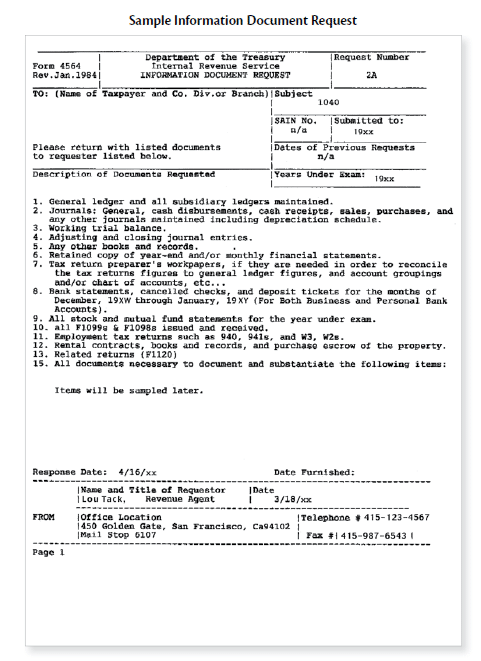

Take a look again at your initial audit notice and the materials from the IRS. Something called an “information document request,” or IDR, may have come with it.

An IDR is a request that you bring to the audit certain documents or information either in your possession or accessible to you. Bank statements and canceled checks are typical IDR items.

The IRS knows well the truth of the words of a Supreme Court Justice that “a person can be defined by the checks he writes.”

Infield audits, revenue agents commonly issue follow-up IDRs when they haven’t seen everything at the first appointment. Typically, you’re given a few weeks to mail the items to the agent or you are asked to bring them to the next meeting.

An IDR carries no legal force. If you don’t provide what was asked for, the auditor cannot do anything to you, other than denying your deduction or exemption.

TIP

If an item is relevant to your audit and not likely to cause harm, you might as well turn it over. This is especially true if it’s a bank record the IRS already knows exists. The IRS has other means to obtain those if they really need to and your lack of cooperation may raise suspicions.

If you don’t understand an item’s relevance to your audit, however, simply decline to provide it. For example, the IRS commonly uses IDRs to request copies of other years’ tax returns—and it’s rarely a good idea to supply them.

If you would rather not discuss the item requested, simply ignore the IDR. Then, if the auditor pursues it, ask for justification of how the item or items requested relate to the year audited. If you still believe the IRS is crossing the line, just say no.

If an item being requested may severely damage or incriminate you, see a tax attorney before you have any conversation with the auditor.

For part two of this article, click here.