Money magazine estimates that between 25% and 50% of automated adjustment notices are erroneous. A common IRS mistake is not finding an income item that was reported elsewhere on the tax return. This can result in incorrectly misreported income, as illustrated below:

EXAMPLE:

Hilary reported $457 of money market fund income as interest. The financial institution labeled it as dividends in its report to the IRS. While dividends are listed right after interest on the IRS form, the computer concluded that Hilary did not report the money. Hilary was erroneously billed for tax, penalties, and interest of $194. She needs to take action, as described next.

Table of Contents

Responding to an Automated Adjustment Notice

If so many automated adjustment notices are wrong, why does the IRS send them?

Money magazine found that most people billed for $589 or less paid without questioning. Consequently, the IRS collects $7 billion a year to which it is not entitled.

You don’t have to be such a victim. You can easily fight an automated adjustment notice. Here are the steps to take.

TIP:

Contesting delays the final tax bill, even if you are wrong. This gives six months or longer to get the payment together—but interest is running.

1. Call the IRS

If the telephone number isn’t on the notice, call 800-829-1040.

Ask the IRS representative for a full explanation of the automated adjustment, even if you suspect the IRS may be right. If you are prepared, state why you believe the notice is wrong—for example, if the IRS claims you didn’t report something, point out where on your tax return it is.

If you don’t clear up the matter on the phone, ask the IRS to note on its records that you disagree with the notice. Write down the time and date of the call, and ask the IRS representative for his or her name and badge number.

Just asking may cause the person to take extra care.

2. Contest in writing

If you don’t object in writing within 60 days of the date on the notice, the adjustment becomes final. So don’t rely on a telephone call alone to straighten out an IRS problem.

TIP:

Object, in writing, in all cases—even if the IRS representative agreed over the phone to correct the automated adjustment.

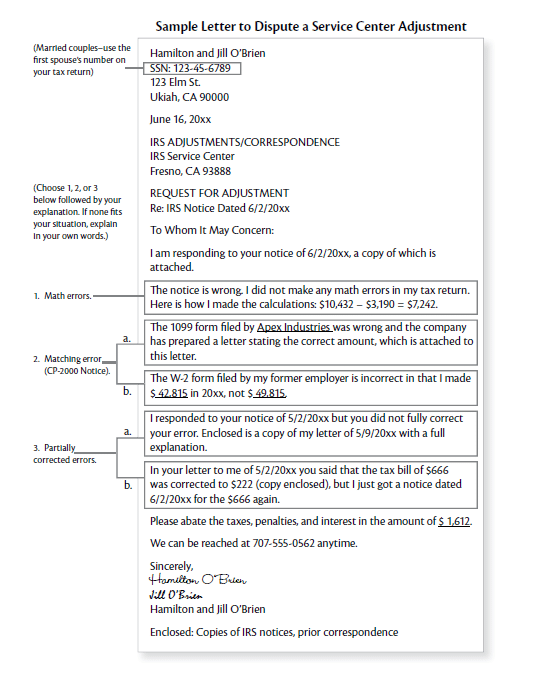

To contest automated adjustment notices, simply send a letter to the address on the notice. Here are some tips for less hassle and better results:

- Be brief and to the point. IRS correspondence clerks have short attention spans. They won’t struggle through long-winded explanations or bad handwriting.

- Staple a photocopy, not the original, of the IRS notice to the front of your letter. Mail it certified, return receipt requested, if you can.

- Include any documentation, such as a copy of the tax return highlighting where the income has been listed, or a birth certificate for the omitted dependent.

- Use the IRS bar-coded return envelope included with your notice. It speeds up processing!

Follow the sample letter below!

Keep copies! Whenever writing the IRS, always make several photocopies of whatever you send. If the IRS misplaces your first correspondence, you can send it again—and again, if necessary.

3. If all else fails, go to court.

If you don’t respond to an automated adjustment notice or the IRS rejects your explanation, it will send you by certified mail something called a notice of deficiency (informally called a 90-day letter).

If you receive this notice and want to contest it, you must file a petition in U.S. Tax Court within 90 days of the date on the letter.

See here for more information about filing a tax court petition (Chapter 9).