You lost your audit and didn’t do any better with your appeal. You are ready to swallow hard and accept your fate. But before pulling out your checkbook and turning over your life savings to the IRS, consider going to tax court.

Each year, over 30,000 individual taxpayers file in tax court. Your chance of winning—at least partially reducing an audit bill—is excellent.

Filing a case in court shows the IRS you mean business. Once the IRS receives notice of your tax court petition, the government often compromises. Over 80% of tax court cases filed settle without ever seeing a judge.

Even if the IRS doesn’t settle, you might win at least a tax reduction from the judge.

TIP:

More than 50% of all petitions filed in tax court bring some tax relief. In cases with $50,000 or less at stake, about half of all taxpayers win something. In cases with over $50,000 at stake, 60% of taxpayers come out ahead.

Tax court isn’t a total panacea, however; the chance of a complete victory over the IRS is only 5%.

In addition, filing in tax court delays your audit bill for a year or longer. Even if you lose, you will have bought time to get your finances in order without worrying that the tax collector will ride off in your new Ford pickup truck. Of course, interest does accrue during this period, which is the downside. But given that more than one out of two people get an audit bill reduced in tax court, this trade-off is usually worth it.

Table of Contents

Tax court is not part of the IRS

The nineteen tax court judges are independent and appointed by the president for 15-year terms. They are lawyers with experience in tax matters, usually gained working for the IRS or in private practice. Don’t let the fact that many tax court judges are often ex-IRS employees dissuade you.

The judges are not automatically pro-IRS. In general, they disapprove of auditors who don’t give taxpayers a fair shake. You’ll get as impartial a trial here as you would in any other federal court. The impartiality of the judge is very important because you do not have the right to a jury trial in tax court.

When not to go to tax court

A person who uses the tax court to protest the tax system as unconstitutional or who refuses to file tax returns can be penalized for filing a frivolous lawsuit. These people may be fined $25,000 or more. You can almost always find a legitimate reason for disagreeing with an audit report. So don’t hesitate in going to tax court if you have legitimate grounds to dispute the audit report.

As mentioned, one minor drawback of tax court is that interest continues to run on your tax bill if you lose. Alternatively, you could pay the bill in advance to stop the interest accrual. Label the check “deposit/cash bond” on the memo line in the lower left-hand corner. Send a cover letter stating that you are making a deposit/cash bond. If you win your case, you’ll get a refund—but the government does not pay you interest for the time it had your money.

Don’t wait too long

The envelope you send to the tax court with your petition and other papers must bear a U.S. mail postmark within 90 calendar days of the date on the notice of deficiency. If it arrives in Washington after day 90, that’s okay, as long as it’s postmarked within the 90-day period. Note that 90 days does not mean three calendar months.

Tax court small cases

There is a small-case division of the tax court for audits in which the IRS claims the taxes and penalties owed for any one tax year are $50,000 or less.

EXAMPLE:

If you’ve been audited for three years and the amount the IRS claims you owe for each year is $30,000—meaning the total is $90,000—your case will still qualify as a small case.

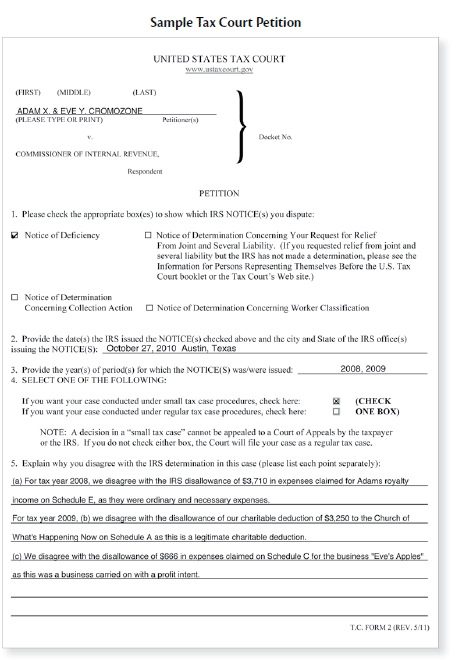

This small claims court–type case is called an S case. S-case election is made on the tax court petition form by checking a box (see the filled-in sample form below).

The filing fee is $60, and normally you’ll have no further court costs.

No jury trials are allowed in tax court. Judges can rule on the spot, although they usually mail their decisions to you a month or so after the hearing. You cannot appeal the decision in an S case.

With S cases, tax court operates much like your local small claims court. You tell the judge your story, show your evidence, and are not expected to know legal procedures. Even if you lose, you have the satisfaction of having had your day in court.

If you’re going to court on your own, it’s highly recommended that you file a small case. Otherwise, get a tax pro to represent you.

Preparing and filing a small-case petition

You will need a petition, a Request for Place of Trial, and a Statement of Taxpayer Identification Number. The forms and instructions are available online from the U.S. Tax Court website at www.ustaxcourt.gov.

Contact the clerk of the U.S. Tax Court – 400 Second Street, NW, Washington, DC 20217, 202-521-0700, and ask for a petition kit. Unlike many other government agencies, the tax court office is very responsive and efficient. There is no charge for these items, which will be sent promptly.

Completing the tax court forms

First, read Information About Filing a Case in the United States Tax Court. This is the first page of the petition kit. You can fill in the forms online or print them out and fill in the hard copy.

Look at the completed sample forms and line-by-line instructions below. The Request for Place of TrialandStatement of Taxpayer Identification Number forms are self-explanatory and not reproduced here. Don’t worry about typos or minor errors—the tax court will usually overlook them.

Check the box for “Notice of Deficiency” (for appealing an audit). In the next blank space, type in the date of the IRS-issued notice and the city and state of the IRS office that issued the notice.

Next, write the year or years for which the notice was issued. Next, check the box for either “small tax case” or “regular tax case.” In the next section, explain briefly why you disagree with the IRS.

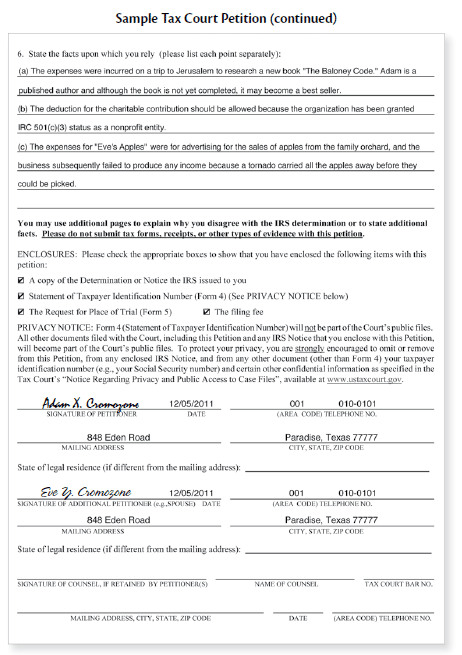

Finally, state the facts on which you rely.

TIP:

The tax court doesn’t expect you to sound like a tax lawyer. Just make sure your point is clear.

EXAMPLE:

“I disagree with the $1,200 deduction disallowed by the IRS. I incurred this expense as the rent I pay on the portion of my apartment I use for my home office.”

Sign and date the petition. After completing the petition, check the box of the nearest city from the list of cities in which tax court trials take place. Type your name and your spouse’s if a joint tax return was audited. Then sign and date the form.

Again, both spouses must sign if a joint return was audited.

Filing the tax court forms

To file your petition, follow these steps (after making sure the filing requirements haven’t changed; see the warning below):

1. Make three copies (or five if it’s a regular case) of these documents:

- Completed petition

- Statement of Taxpayer Identification Number

- Completed Request for Place of Trial, and

- Notice of deficiency—90-day letter—that you received from the

- IRS.

2. Keep one copy of the petition, Request for Place of Trial, and the notice of deficiency for your records.

3. Attach the original notice of deficiency to the original petition, and attach the remaining copies of the notice of deficiency to the remaining copies of the petition.

4. Make out a personal check or money order for $60 payable to Clerk, U.S. Tax Court.

5. Enclose the original and copies of the petition and the notice of deficiency, the original and copies of the Request for Place of Trial, Statement of Taxpayer Identification Number, and your check or money order in a large envelope. Send to Clerk, U.S. Tax Court, 400 Second Street, NW, Washington, DC 20217, by U.S. mail—certified and return receipt requested.

To timely and legally file your petition to the tax court, the envelope must bear a U.S. mail postmark dated within 90 calendar days of the date on the notice of deficiency. Or you can use Federal Express, DHL, or Airborne Express. Currently, you cannot file electronically in tax court. If it arrives after Day 90, that’s okay as long as the postmark is within 90 days.

CAUTION:

Bear in mind that 90 days does not mean three calendar months.

TIP:

Check for any changes to the filing requirements. Call 202-521-0700 or check online at the U.S. Tax Court’s website at www.ustaxcourt.gov.

Within seven days of receiving your petition, the tax court will send you a confirmation of receipt and assign you a case number. If you ever write to or call the IRS or the tax court about your case, you will have to refer to your case number.

You don’t need to file anything else, unless the IRS files a written response, called an answer, stating that you committed fraud. In this highly unlikely event, you must file a legal paper called a reply. You should consult a tax attorney before filing a reply.