An office audit will have you visiting one of the IRS offices. You will schedule a meeting and present the IRS auditor with a number of documents requested in advance.

Table of Contents

What Are Office Audits

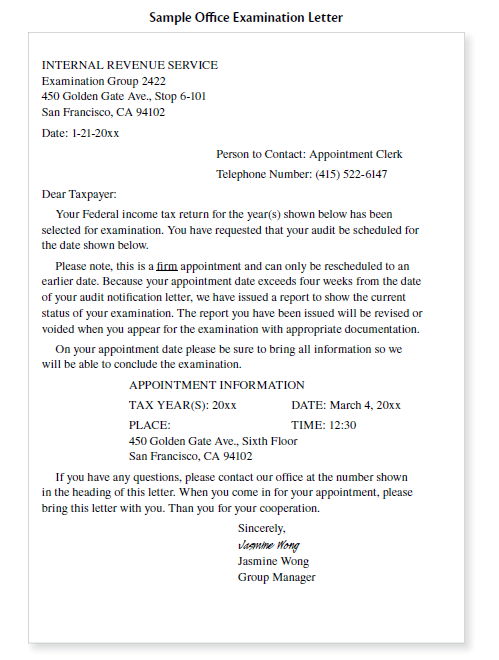

An office examination is announced by a computer-generated form letter (see sample below). It sets a time and date for a meeting at the IRS office or requests that you call to make an appointment.

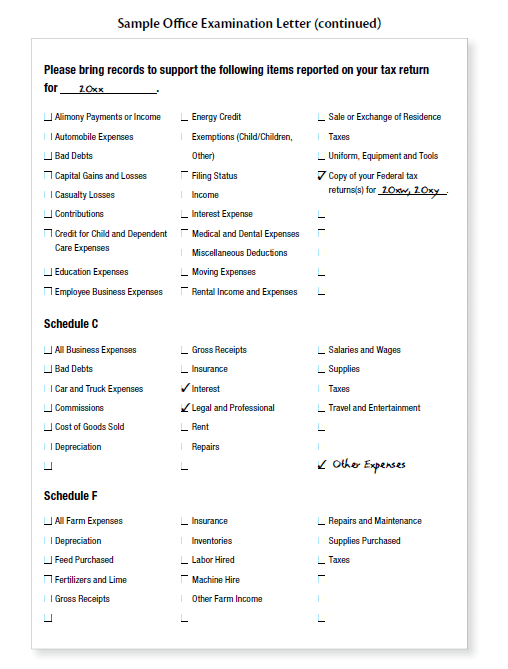

The letter states the year or years being audited, and may specify types of documents you are being asked to bring—such as paid receipts, bank statements, and canceled checks.

Office audits are performed by tax auditors. To keep things simple, we’ll refer to them simply as office auditors.

To learn about other types of audits, click here.

So You Are Subject to an Office Audit – Now What?

Call to Schedule the Audit

After you receive an office audit notice, call the IRS to schedule the audit or confirm your appearance. While your inclination may be to get the audit over with as soon as possible, consider taking a go-slow approach.

The reason for not rushing is simple. Because the IRS must complete the entire audit process within three years of when you filed your return, the longer your audit drags on, the sooner the deadline approaches. When the auditor is under pressure to close your file, the likely result is fewer adjustments being made on your return.

Here are some scheduling suggestions

Don’t call right away

Don’t call the IRS the day the notice arrives. Wait a while. Two weeks is soon enough to respond to an audit notice. The IRS does not award gold stars to early callers.

Schedule far in the distance

Make the audit appointment as far into the future as possible. Don’t underestimate the time you will need to

locate and get your records in order. No matter how much of an ace record keeper you are, you’ll be unable to find something when you hunt for it. Ask for at least a month or two away for your appointment.

TIP

The Taxpayers’ Bill of Rights gives you a say in scheduling the appointment. Don’t let anyone at the IRS tell you otherwise!

Schedule late in the week and day

Ask for your office audit appointment on Friday, and if possible, late morning—just before the auditor’s lunch

break—or late afternoon. Friday afternoons are perfect, especially right before a three-day weekend.

Auditors don’t work on commission or get paid overtime, so they look forward to evenings and weekends as much as you do. An auditor may want to go home so badly that he or she will race through without really digging.

Schedule late in the month

Ask for an audit appointment at the end of the month. Because IRS managers are prohibited from judging auditors on tax dollars produced, they measure performance in the number of file closings per month. If the auditor is behind in clearing out that month’s case files, he or she may zip along to avoid a bad performance review. It’s kind of like a car salesperson meeting a quota.

Reschedule the audit

To buy more time, call a day or two before your audit appointment and ask that the meeting be rescheduled.

TIP

Despite language in the IRS confirmation notice to the contrary, the IRS usually grants one or two postponements for almost any reason.

Perhaps you haven’t received copies of vital documents, such as canceled checks from your bank. Or maybe your accountant is out of town, you are busy at work, or there is an illness in your family.

Don’t worry if you can’t find all your papers. On the day of the audit, you may not have been able to find all the necessary records. When the auditor asks for them, apologize that you were unable to get them and ask for a couple of more weeks. If the deadline for getting the missing documents to the auditor is approaching, call and ask for a little more time. The auditor may grumble, but will probably allow it.

TIP

If the auditor isn’t being nice, he or she doesn’t want you to appeal the audit reports.